Markets were closed yesterday in honor of President’s day, so today (Tuesday) is the first day of market action for the week.

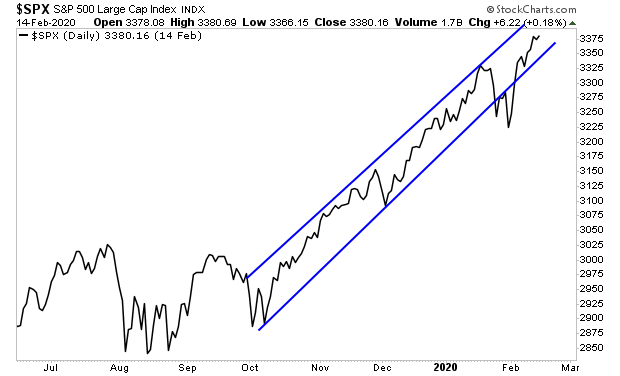

Stocks are slightly down as I write this, (less than 0.5). The S&P 500 remains in a clear bull market channel. But there are signs we could see a pull-back (think 3% or so).

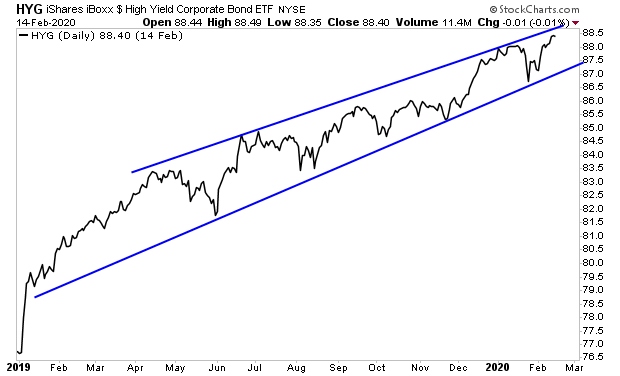

Stocks follow credit. And credit has just hit the level at which I would expect to see a pullback of sorts.

—————————————————–

Get a LIFETIME Subscription to All Of Our Products For Just $2,500

An annual subscription to all of our current newsletters costs $1,500.

But today, you can get a LIFETIME subscription to ALL of them, along with every new product we ever launch, for just $2,500.

That’s less that the cost of two year’s worth of subscriptions.

And if you are already a paying subscriber to one or more of our newsletters, we will refund your current orders, if you take advantage of this offer.

To do so…

——————————————-

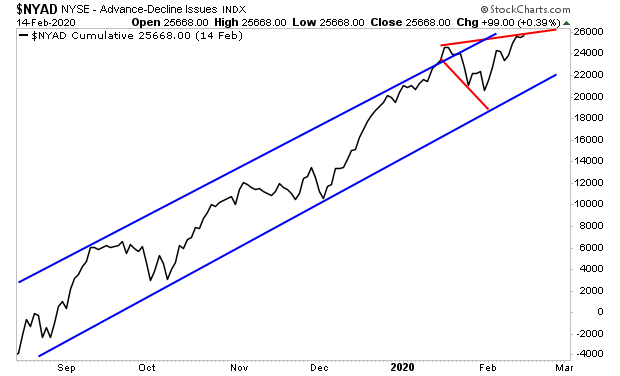

The same is true of breadth. If we were going to see a pullback, there is where I’d expect it to hit.

Put simply, if we are going to get a pullback, it should start this week. But based on the market’s internals and price action, this pullback should be shallow (think 3% or so) and used as a buying opportunity.

Why?

Stocks are a discounting mechanism. And they are the most accurate forecaster of future events in history. So, this raises the question… what is the stock market discounting with the recent global breakout?

I believe the market is discounting a landslide victory for President Trump in 2020, followed by an economic boom in the U.S.

The fact is that for 20 odd years, the U.S. has been relatively weak from an economic perspective. Most of the economic growth was driven by asset bubbles, not a growth in incomes or innovation.

Beyond the internet, what major innovation of the last 20 years can we point to? Social media hasn’t increased productivity in any meaningful way. Crypto-currencies are just another investing fad driven by excess liquidity. Sure, computers are faster… but has anything truly revolutionary occurred?

The answer is no.

I believe this will change in the coming months and years. The combination of the Trump administration’s regulation cutting, and the Fed’s monetary easing, is going to provide risk-takers, entrepreneurs, and innovators with a unique environment in which new, revolutionary ideas can truly ignite.

This is what U.S. stocks began to discount when they broke of two-year consolidation range in mid-2019. At that it was evident that the impeachment farce would go nowhere and that the Fed finally began to ease again.

This is going to ignite a global melt-up. The U.S. is the largest economy in the world with a GPD equal to that of the 2nd, 3rd, and 4th largest economies combined.

Which is why U.S. stocks were the first to ignite to the upside. The Global Dow has only just joined in, breaking out of its own two-year consolidation range.

Yes, for the last two years global stocks have gone nowhere. They have only just begun to catch wind of what U.S. stocks figured out six months ago.

I want to be clear here…

I DO NOT care about politics. You can hate President Trump or you can love him. That’s 100% up to you.

But the reality is that under the Trump administration the stock market is giving us a once in a lifetime opportunity to GET RICH from our investments.

My clients are already doing this with our new special report titled…

The MAGA Portfolio: Five Investments That Will Make Fortunes During Trump’s Second Term.

In it, I detail five HIGH OCTANE investments that are primed to EXPLODE higher when President Trump wins a second term.

In it, I detail five unique investments that I expect will produce the most extraordinary gains during President Trump’s second term.

Each one of these investments is in a unique position to profit from the combination of Trump economic reforms and Fed monetary easing, combining high growth opportunities with extreme profitability.

We are offering this report exclusively to subscribers of our e-letter Gains Pains & Capital. To pick up your copy please swing by:

https://phoenixcapitalmarketing.com/MAGA.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research