The market dip I wrote about last week has finally hit.

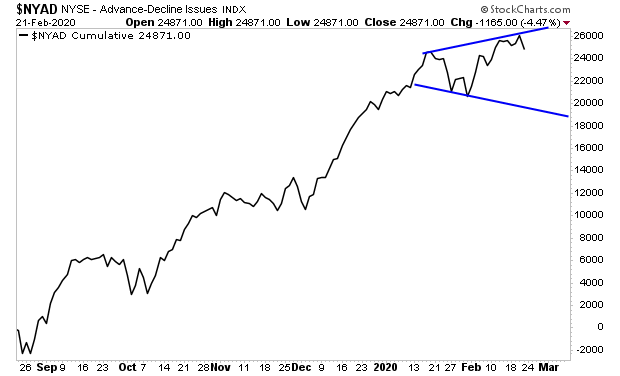

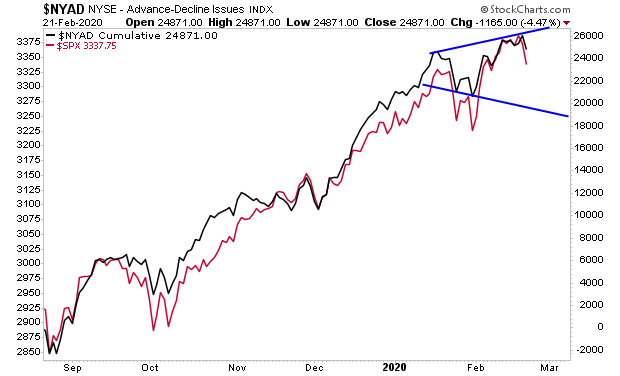

Breadth warned this was coming last week, when it struggled to go vertical mid-week. We have a megaphone formation in place that suggests we’ll see a bit more downside here.

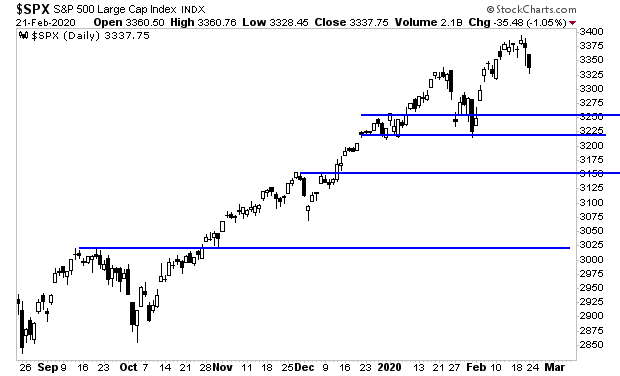

Breadth leads stocks, and this formation suggests stocks won’t find a lot of support until we get to 3,250 or so.

If that doesn’t hold, stocks have additional support at 3,220, 3,150 and finally 3,025.

Personally, I don’t believe we’ll break 3,225 before the Fed intervenes.

The coronavirus outbreak has given central banks the excuse they needed to begin intervening in the market more aggressively.

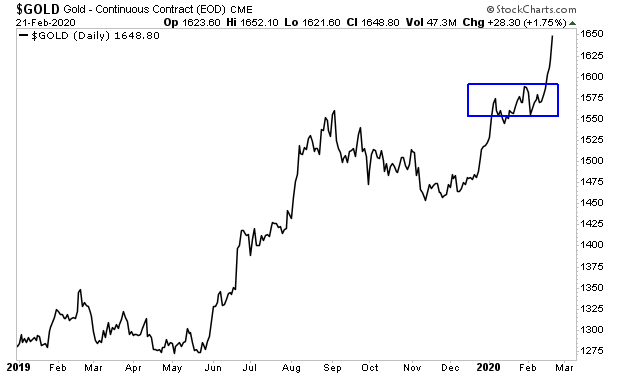

Gold had already begun to pick up on this.

Starting last week, the precious metal began to discount a LOT more money printing coming from the Fed.

Moreover, the odds are EXTREMELY low that President Trump is going to let his beloved stock market crash during an election year.

Which is why we can all but guarantee a MASSIVE Fed intervention is coming. And when it does the stock market will roar higher.

I want to be clear here.

I DO NOT care about politics. You can hate President Trump or you can love him. That’s 100% up to you.

But the reality is that under the Trump administration the stock market is giving us a once in a lifetime opportunity to GET RICH from our investments.

My clients are already doing this with our new special report titled…

The MAGA Portfolio: Five Investments That Will Make Fortunes During Trump’s Second Term.

In it, I detail five HIGH OCTANE investments that are primed to EXPLODE higher when President Trump wins a second term.

In it, I detail five unique investments that I expect will produce the most extraordinary gains during President Trump’s second term.

Each one of these investments is in a unique position to profit from the combination of Trump economic reforms and Fed monetary easing, combining high growth opportunities with extreme profitability.

We are offering this report exclusively to subscribers of our e-letter Gains Pains & Capital. To pick up your copy please swing by:

https://phoenixcapitalmarketing.com/MAGA.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research