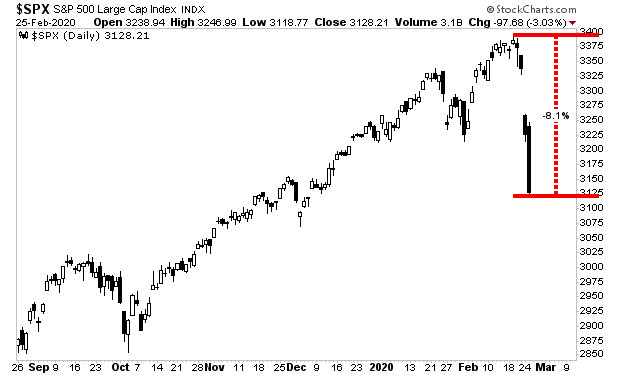

The big development in the last week has been that institutional sellers have hit the market.

For the last six months stocks have gradually grinded higher with every dip being both small in size and aggressively bought. This was a clear signal that institutions were on the sidelines.

No longer, the overwhelming selling pressure of the last few days has been the product of institutions selling in a big way.

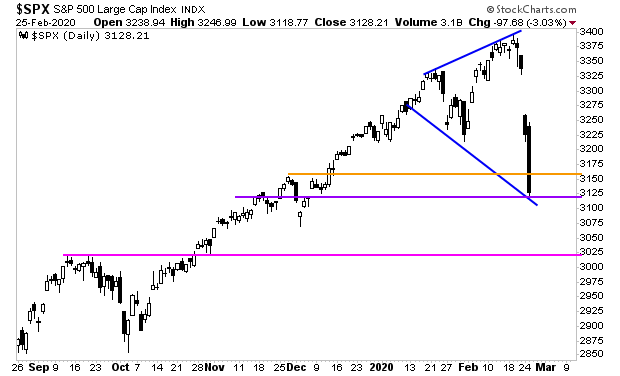

The S&P 500 has smashes through multiple lines of support. As I write this it is hanging to support around 3,120 by a thread. If this goes, we could easily do a final flush to 3,025.

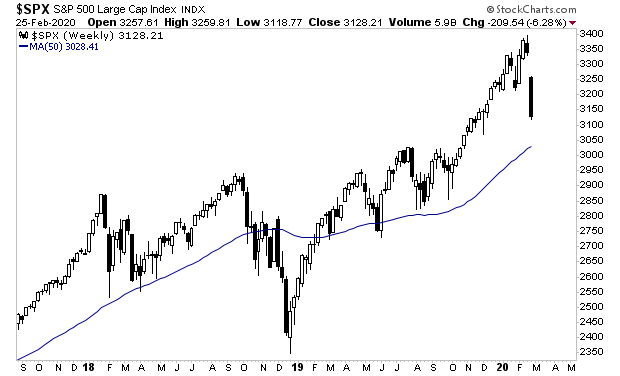

That is right around the 50-week moving average, which has acted as a magnet for sell-offs during the last few years.

Many clients are asking us…Is the bull market over?

Consider that the economy continues to grow, and the Fed continues to ease. Unless one of those two things change, then this is a terrific buying opportunity just as it was throughout 2019.

But what about the Coronavirus?

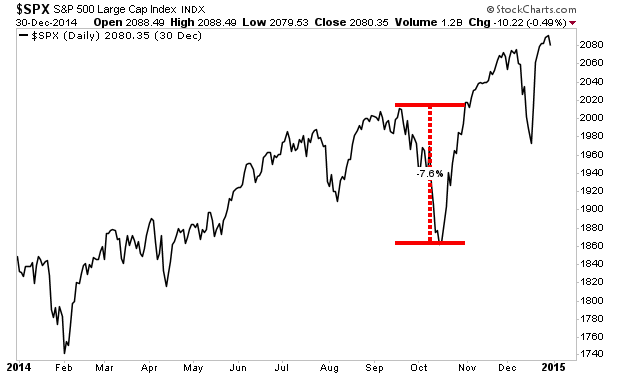

During the Ebola scare of 2014, stocks dropped 7%. They then staged a V-shaped recovery and ROARED higher.

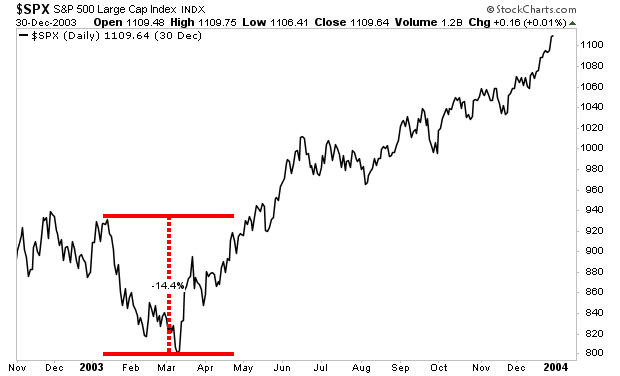

During the SARS scare of 2003, stocks fell 14%. They then staged a V-shaped recovery and ROARED higher.

As I write this today, stocks are already down over 8%.

Is coronavirus worse than Ebola or SARS? I have no idea. But unless it’s EXPONENTIALLY worse, stocks should be bottoming soon.

After all, what are the odds President Trump is going to let his beloved stock market go down the toilet during an election year?

I DO NOT care about politics. You can hate President Trump or you can love him. That’s 100% up to you.

But the reality is that under the Trump administration the stock market is giving us a once in a lifetime opportunity to GET RICH from our investments.

My clients are already doing this with our new special report titled…

The MAGA Portfolio: Five Investments That Will Make Fortunes During Trump’s Second Term.

In it, I detail five HIGH OCTANE investments that are primed to EXPLODE higher when President Trump wins a second term.

In it, I detail five unique investments that I expect will produce the most extraordinary gains during President Trump’s second term.

Each one of these investments is in a unique position to profit from the combination of Trump economic reforms and Fed monetary easing, combining high growth opportunities with extreme profitability.

We are offering this report exclusively to subscribers of our e-letter Gains Pains & Capital. To pick up your copy please swing by:

https://phoenixcapitalmarketing.com/MAGA.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research