The futures market soared over the weekend on announcements by the Bank of Japan that it would ease monetary conditions if needed to ease the impact of the coronavirus on Japan’s economy.

The question for traders this week is whether other central banks will join in on the verbal intervention.

Most important will be the Fed.

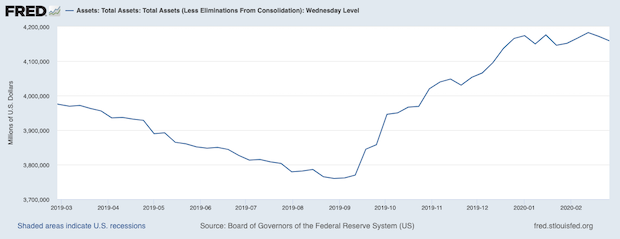

Lost amidst all the talk of the coronavirus and potential global economic contraction is the fact that the Fed’s balance sheet has been flat to down since early-December. This tells us the Fed completely ended the aggressive liquidity pumps it was running from August through the end of the year.

If the Fed begins to provide liquidity again, or we see a verbal intervention from a major Fed official (Powell, Clarida, etc.) stocks should roar higher.

The market is extremely oversold in the near-term while at the final level of support. Stocks NEED to hold here.

Personally, I believe the market will force the Fed’s hand. The Fed is trying to talk tough, but at the end of the day, the Fed has lost every game of “chicken” it has played with the markets since 1987.

This time will be no different. Whether stocks bottom right now or later this week or next, the downside should be limited from here.

I’m not saying I like the Fed, or even that a Fed intervention is the RIGHT thing to do… I’m just saying that I believe the Fed will lose this game of chicken with the markets and stage and intervening over the weekend or early next week.

For that reason, personally, I am bullish, INSANELY bullish about the markets.

If things even marginally improve, we are going to get a “rip your face off” V-shaped recovery in the markets.

After all, what are the odds President Trump is going to let his beloved stock market go down the toilet during an election year?

I DO NOT care about politics. You can hate President Trump or you can love him. That’s 100% up to you.

But the reality is that under the Trump administration the stock market is giving us a once in a lifetime opportunity to GET RICH from our investments.

My clients are already doing this with our new special report titled…

The MAGA Portfolio: Five Investments That Will Make Fortunes During Trump’s Second Term.

In it, I detail five HIGH OCTANE investments that are primed to EXPLODE higher when President Trump wins a second term.

In it, I detail five unique investments that I expect will produce the most extraordinary gains during President Trump’s second term.

Each one of these investments is in a unique position to profit from the combination of Trump economic reforms and Fed monetary easing, combining high growth opportunities with extreme profitability.

We are offering this report exclusively to subscribers of our e-letter Gains Pains & Capital. To pick up your copy please swing by:

https://phoenixcapitalmarketing.com/MAGA.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research