The markets are bouncing hard in the overnight session.

The Trump administration announced last night that they are planning a number of fiscal measures to prop up the economy. Those include a payroll tax, loans to companies that are being hurt by the economic fallout from coronavirus, and other items.

The actual plan will be unveiled today.

After it is unveiled, the President will have to figure out how to get it through Congress… which is a whole issue.

On top of this, the President has invited all of the Wall Street CEOs to the White House to discuss the economy and financial markets. This is a very similar move to the phone call Treasury Secretary Steven Mnuchin had with Wall Street during the December 2018 meltdown.

Put simply, the Trump administration is about to throw the “kitchen sink” at the coronavirus situation. Whether this will alleviate the pressure in the credit market remains to be seen.

The U.S. is not alone in this. The Bank of England is preparing to take “joint action” with the UK Treasury on Wednesday. And the ECB meets Wednesday and Thursday.

Put simply, we are about to see another round of coordinated global interventions. The big difference this time is that policy makers are introducing fiscal measures, rather than monetary ones.

What this means is that rather than having central banks funnel money into the markets, governments are now trying to inject money directly into the economy.

This is the beginning of helicopter money.

And that is a very different thing from mere rate cuts and QE from central banks.

The markets are going to bounce based on all of this. Whether this is a major bounce that kicks of a real V-shaped recovery, or just a dead cat bounce remains to be seen.

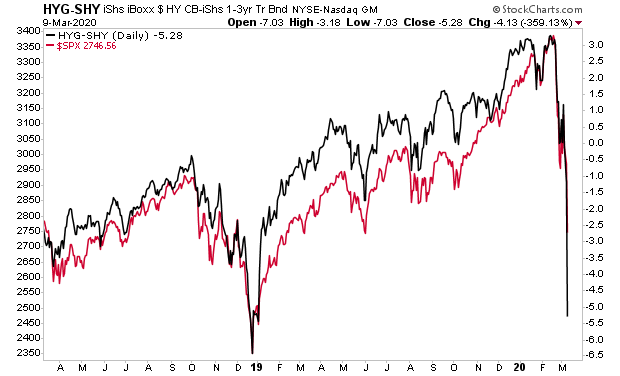

The credit market is suggesting a crisis is brewing. The question now is whether or not policy makers can avert it. But right now, credit suggests the S&P 500 could drop to 2,450 or so.

In light of this, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments willperform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best RegardsParagraph

Graham Summers

Chief Market Strategist

Phoenix Capital Research