The world is facing two crises.

The first, coronavirus, is manufactured, the second, a credit implosion, is very real.

The coronavirus panic was 100% made up and manufactured by the media. Globally 100,000 people have been infected and a little over 3,000 have died. Swine Flu infected 60 MILLION and KILLED 60,000 people, in the U.S. alone.

No one shut down their economy over swine flu. No one stock piled toilet paper. No one talked about the end times. Those are facts.

However, now that the elites are shutting down things, the economy will take a real hit. If large group meetings are considered a danger, then factories, companies, schools, conferences and the like will be canceled. And that will hit the economy HARD.

Now let’s talk about the REAL crisis that is hitting the financial system.

As you are no doubt aware, there is too much debt in the financial system. Globally Debt to GDP is north of 200%. Leverage is higher today than it was in 2007. And the world is absolutely saturated in debt on a sovereign, state, municipal, corporate and personal level.

However, everything continued to run smoothly as long as nothing began to blow up in the debt markets/ credit markets. And despite a few hiccups here and there, the debt markets have been relatively quiet for the last few years.

Not anymore.

Someone or something is blowing up in a horrific way “behind the scenes.”

The Fed was FORCED to start providing over $100 BILLION in free money overnight back in September 2019. And even that massive amount is proving inadequate (last night the Fed was forced to pump $216 BILLION into the system).

You don’t get those kinds of demands for liquidity unless something is truly horrifically wrong. Think LEHMAN BROTHERS.

This is why the markets are failing to rally. It is why every major central bank is out talking about launching new aggressive monetary policies. And it is why the Fed is privately freaking out.

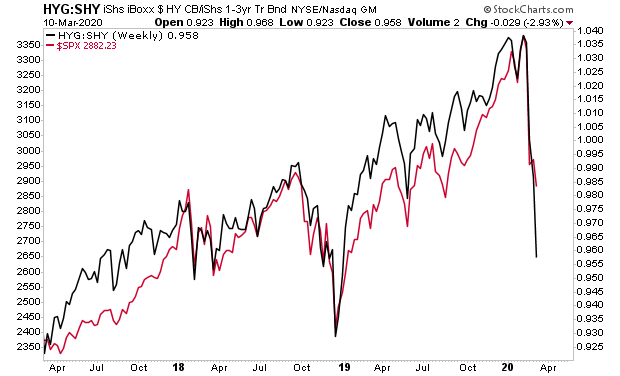

Below is a chart showing the credit market (black line) relative to the stock market (red line). As you can see, the credit market is already telling us that stocks should be trading at 2,600 or even lower.

This is a real crisis. And from what I can see, the Fed can’t stop it.

What stopped the last crisis?

The Fed fought back by launching rate cuts and QE.

This crisis started when the Fed was already doing rate cuts and QE.

And those policies aren’t doing anything to stop the bloodbath.

In light of this, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments willperform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best RegardsParagraph

Graham Summers

Chief Market Strategist

Phoenix Capital Research