The markets are bouncing limit up this morning on two things:

Bear markets always have face ripper rallies. Is this the start of one… or is this just another one-day blip similar to that which happened on Tuesday? I have no idea. And in fact no one does.

Investing is not about being psychic… it’s about playing the hand you are dealt.

The hand we have been dealt today is this:

- The markets have just suffered their worst one-day collapse since the 1987 Crash.

- The markets are down over 20% across the board with some indexes having wiped out ALL of their gains going back to the 2016 election.

- The markets are EXTREMELY oversold with investor sentiment the worst since the 2008 Crisis.

- We are heading into the weekend… or 48 hours during which the markets are closed and any number of developments can occur.

Unfortunately that is not the worst new either.

Do NOT let the market rally distract you from what happened yesterday.

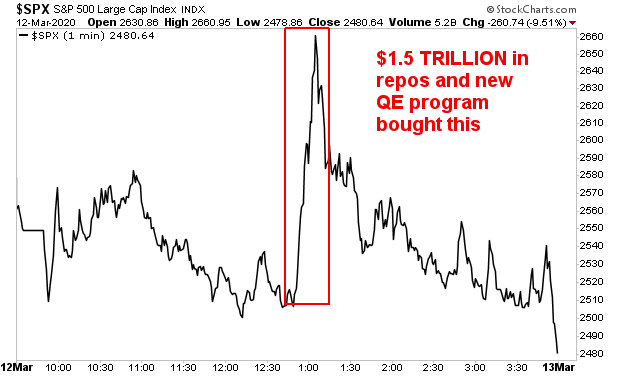

Yesterday, the Federal Reserve, the single most importance central bank in the world, announced a $1.5 TRILLION repo operation as well as a new QE program… and stocks only rallied for FIVE minutes, before closing on the LOWS.

Again, stocks had their worst day since the 1987 Crash on the day the Fed announced a $1.5 TRILLION intervention. THAT, is THE story of this week.

The implication?

Something truly HORRIFIC is happening behind the scenes. We’re talking about something far worse than Lehman Brothers. Some large, and I mean LARGE institution (think Deutsche Bank, UBS, or something of that size) is in MAJOR trouble.

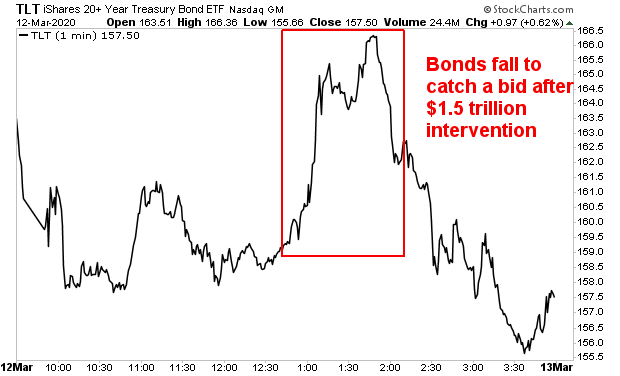

What’s TRULY horrifying is that bonds actually COLLAPSED yesterday despite the Fed announcing this $1.5 trillion program. If bonds cannot find a floor when the Fed announces QE 5 as well as $1.5 trillion in repos, then we have a problem that is far, far greater than anything the world has ever seen.

Let’s be clear here… what the Fed did was not a bazooka… it was a NUCLEAR option… and it didn’t stop the collapse.

The Fed now has few options left. Which means, if the market bounce doesn’t last, and stocks turn down again… the Fed is effectively POWERLESS to stop what’s coming.

So, what happens now?

The S&P 500 is down 27% since its peak in only 16 days.

The only two comparable situations in history that I know of are the 1987 Crash and the 1929 Crash, which saw stocks lose 34% in 11 days and 20 days, respectively.

In both instances, stocks bounced only two days or so before revisiting the lows or falling to new lows.

In light of this, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research