Thus far in this crisis, the Fed has:

1) Cut interest rates from 1.25% to 0.15%.

2) Launched over $700 billion in Quantitative Easing (QE).

3) Launched a $1.5 TRILLION repo program.

4) Launched another $1 trillion repo program.

5) Announced it will begin buying commercial paper (short-term corporate debt).

6) Allowed primary dealers to start parking assets, including stocks, as collateral in exchange for short-term credit.

7) Opened Euro-Dollar swaps (this implies systemically important banks in Europe are in danger of collapse).

Under any set of circumstances, the above set of policies would be considered the NUCLEAR option. The fact that the Fed has launched ALL of these in the span of three weeks is beyond incredible.

In the simplest of terms, the Fed has effectively used up ALL of its ammo in less than a single month. At this point, there truly is not much else the Fed can do.

And the markets continue to implode. As I write this, the futures markets are once again LIMIT down, meaning they had to be frozen after falling 5%.

Enter former Fed Chairs Ben Bernanke and Janet Yellen.

In an opinion editorial piece in the Financial Times this morning the two former Fed Chairs urged the Fed to begin buying corporate debt and stocks.

Currently the Fed is forbidden from doing either as per the Federal Reserve Act. Put another way, congress would need to authorize the Fed to start buying these assets.

The two former Fed Chairs are providing the political cover to do this. I fully expect the Fed to begin outright buying stocks, corporate debt, and other assets within the next six weeks.

Put another way, the Fed is going to begin going what some call “Weimar-Lite” or effectively buying everything.

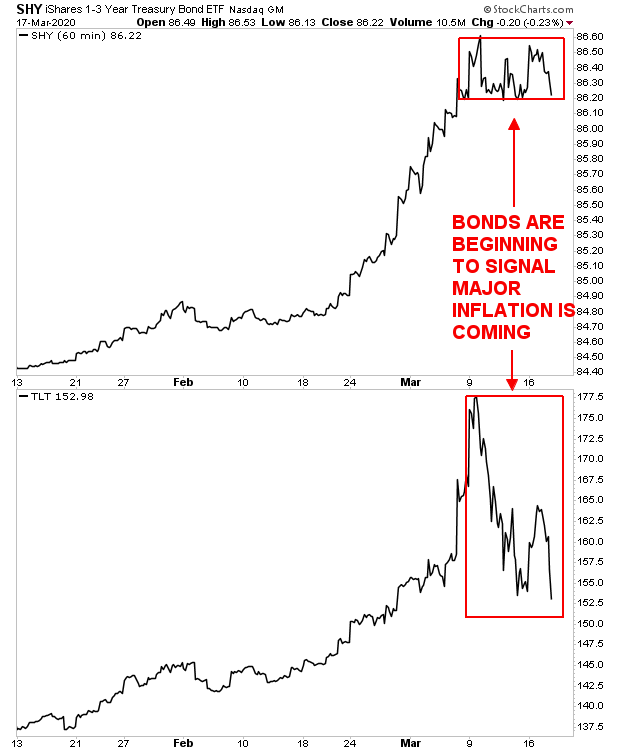

This is why bonds are dropping across the board despite the clear signs that the financial system remains under MAJOR duress… bonds realize that the fed and other Central banks are going to opt for INFLATION to stop the crisis (and I’m not talking about the plain vanilla 2% per year kind).

The time to start preparing for this is now. The crisis is not over… if anything it is just beginning.

In light of this, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

As I write this there are less than 50 copies left available to the public.

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market StrategistParagraph

Phoenix Capital Research