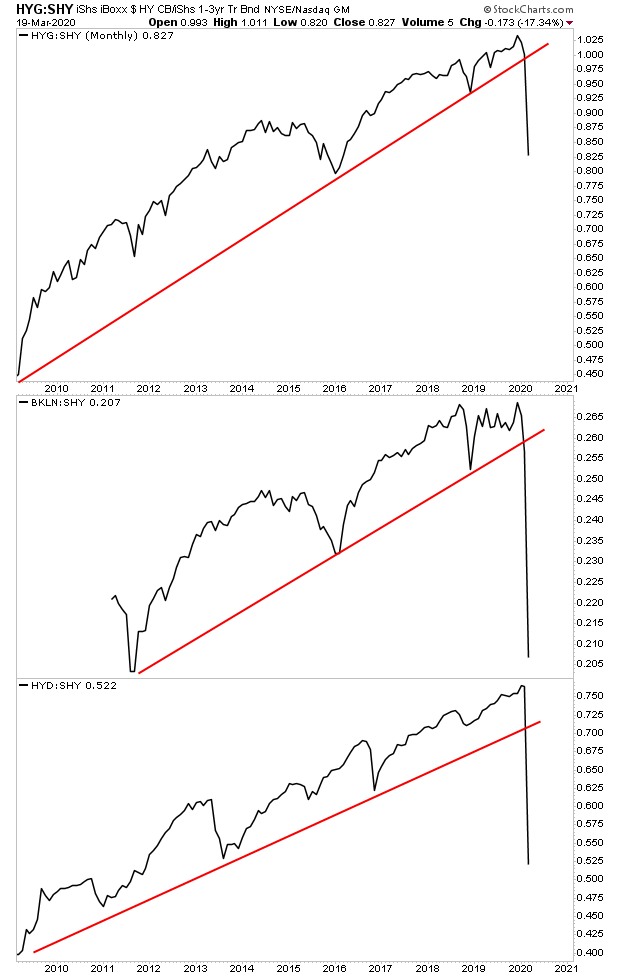

The coronavirus has burst the Everything Bubble.

Regardless of what happens with the economy or the virus, the damage has been done to the massive debt bubble. Across the board, credit and debt markets have ended their bull markets.

To fight this situation, the Fed has gone NUCLEAR with monetary policy. In the last three weeks, the Fed has:

1) Cut interest rates from 1.25% to 0.15%.

2) Launched a $1 5 trillion repo program.

3) Launched a $700 billion QE program.

4) Begun buying commercial paper debt instruments.

5) Opened the discount window to the eight largest banks in the US.

6) Opened dollar swaps with international central banks.

7) Opened credit windows to the money market funds market.

If these policies sound familiar, it’s because the Fed basically just ran through its entire 2008 playbook. The big difference this time is that instead of taking a year to do this like it did in 2008, the Fed ran through all of these polices in less than a month.

Thus far, none of these policies have worked.

As I write this Friday morning, stocks have yet to stage a meaningful bounce. As a result, we are now seeing calls for the Fed to start buying corporate debt and municipal debt.

We are also now beginning to see talk of helicopter money being implemented as well, including mailing checks to people who cannot work due to the coronavirus. This combined with various stimulus programs will mean TRILLIONS being injected directly into the financial system.

This is all going to unleash inflation.

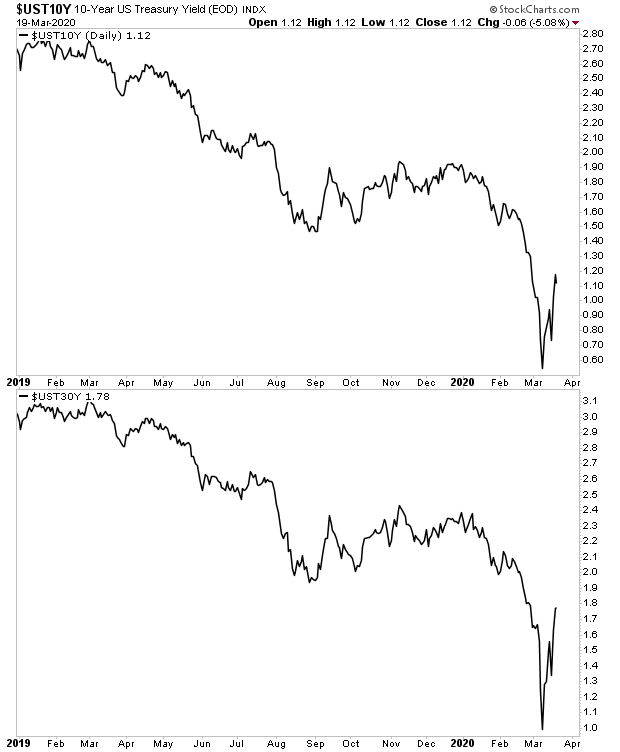

Bond yields have begun rising, suggesting the bond market is beginning to discount inflation hitting the financial system.

This is telling us that the first round of the crisis, the deflationary collapse, will be ending. But the second round, the INFLATIONARY tidal wave, is only just beginning.

We just published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay ou as it rips through the financial system in the months ahead

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU.

We are making just 100 copies available to the public.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research