Yesterday’s action was positive, but we’re not out of the woods by any stretch.

Stocks roared higher with the Dow closing up 11% for its largest single day gain since 1933. Across the board, the buying was extremely strong with 90% of trading volume being up by end of the day.

However, we are not out of the woods yet.

As Bill King recently noted, throughout history there are two only two other instances in which stocks crashed this rapidly. Those are the crash of 1929 and the crash of 1987.

Both of them featured a swift double-digit decline of over 20% in a matter of days.

Both of them featured a MASSIVE two-day rally that saw stocks rise 20%.

Both of them then saw stocks roll over to either retest the lows (1987) or fall to new lows (1929).

———————————————————-

Get a LIFETIME Subscription to All Of Our Products For Just $2,500

An annual subscription to all of our current newsletters costs $1,500.

But today, you can get a LIFETIME subscription to ALL of them, along with every new product we ever launch, for just $2,500.

Today is the last day this offer is available.

To lock in one of the remaining slots…

———————————————————–

The crash of 1929 saw stocks lose 34% in the span of a few days before staging a massive two-day rally of 18%. Stocks then dropped to new lows.

The crash of 1987 saw stocks fall 22% in a single day. They then staged a massive two-day rally of nearly 20% before falling to retest the lows.

The point is that yesterday’s massive bounce doesn’t mean the lows are in. We are still in watch and wait mode for the markets.

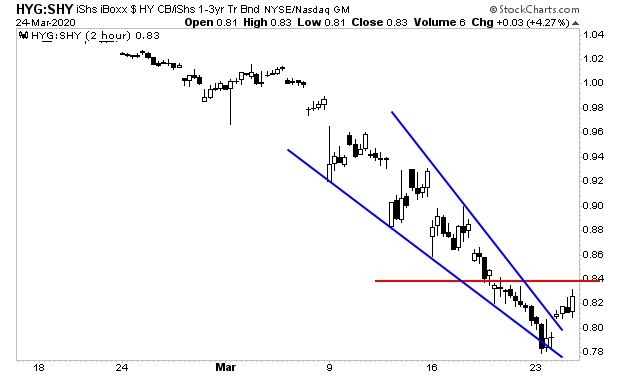

On that note, high yield credit spreads have broken out of their downtrend. However, they have MAJOR resistance right overhead. That HAS to be broken for this rally to have any legs.

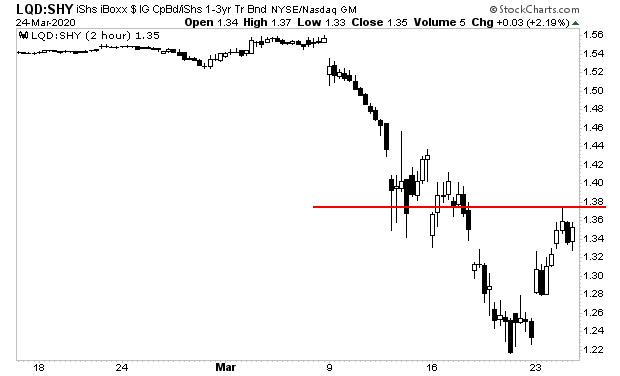

Investment grade credit spreads, which have lead credit during this bounce courtesy of the Fed announcing it will start buying investment grade corporate debt, have already slammed into resistance and rolled over.

My point with all of this is to NOT rush into stock right now. Do not worry about trying to catch a bottom or timing the exact low on the markets. You’re much better off waiting for clear signals that the market has DEFINITIVELY bottomed and THEN start buying.

Best Regards

Graham Summers

Chief Market Startegist

Phoenix Capital Research