Stocks are red this morning.

If you’ve been following my work this week, you shouldn’t be surprised. History tells us that after sharp, severe crashes such as the one from late February to this week, there is usually a sharp two-day bounce.

As Bill King recently noted, throughout history there are two only two other instances in which stocks crashed this rapidly. Those are the crash of 1929 and the crash of 1987.

Both of them featured a swift double-digit decline of over 20% in a matter of days.

Both of them featured a MASSIVE two-day rally that saw stocks rise 20%.

Both of them then saw stocks roll over to either retest the lows (1987) or fall to new lows (1929).

The crash of 1929 saw stocks lose 34% in the span of a few days before staging a massive two-day rally of 18%. Stocks then dropped to new lows.

The crash of 1987 saw stocks fall 22% in a single day. They then staged a massive two-day rally of nearly 20% before falling to retest the lows.

———————————————————–

Get a LIFETIME Subscription to All Of Our Products For Just $2,500

An annual subscription to all of our current newsletters costs $1,500.

But today, you can get a LIFETIME subscription to ALL of them, along with every new product we ever launch, for just $2,500.

Today is the last day this offer is available.

To lock in one of the remaining slots…

———————————————————–

The point is that this week’s massive bounce doesn’t mean the lows are in. We are still in watch and wait mode for the markets. It would be perfectly normal to retest the lows or even break to new nominal lows.

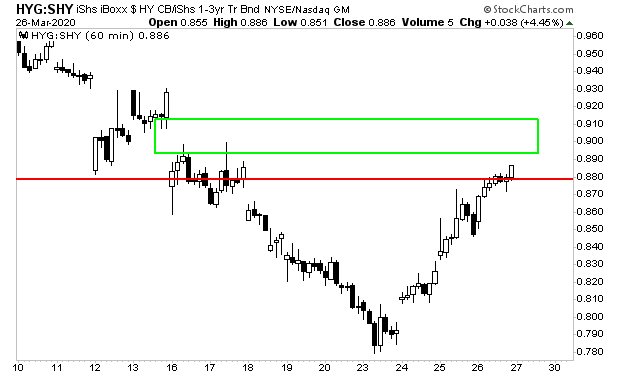

Having said that, the credit markets, which lead stocks have shown signs of improvement,

High yield credit spreads haven broken above resistance (red line). What happens here is key. If they move to close the gap then the rally has legs. If they don’t we’re dropping

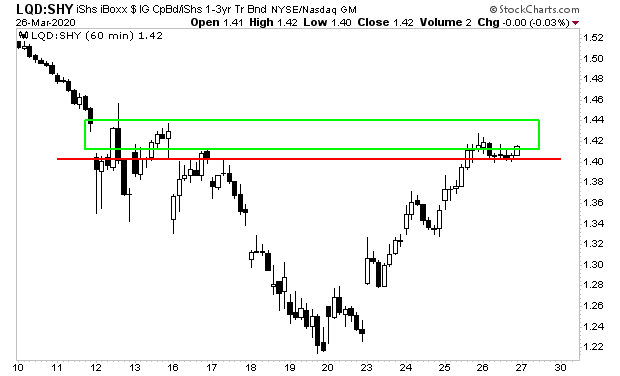

The same is true for investment grade credit spreads.

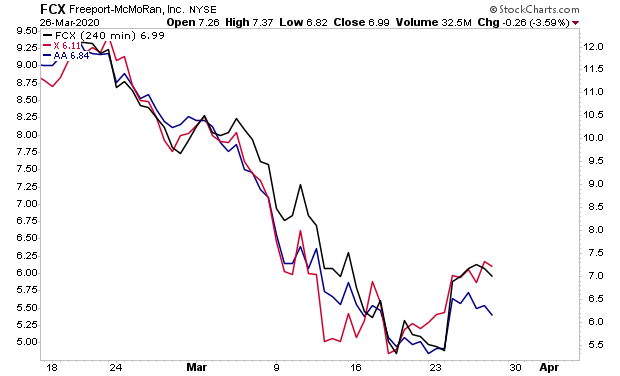

One thing that gives me concern is the fact that industrial metals companies, which are closely aligned with the real economy, all began to roll over yesterday.

I continue to believe stocks will retest the lows and possibly even break to new lows.

In light of this, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

We made 100 copies available to the public.

As I write this there are 39 left.

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research