Stocks are up somewhat this morning.

This marks the second Monday stocks will open in the green (last Monday was a green open as well) following two horrifically bad weekend sessions that saw stocks open limit down or close to limit down (March 2nd and 9th).

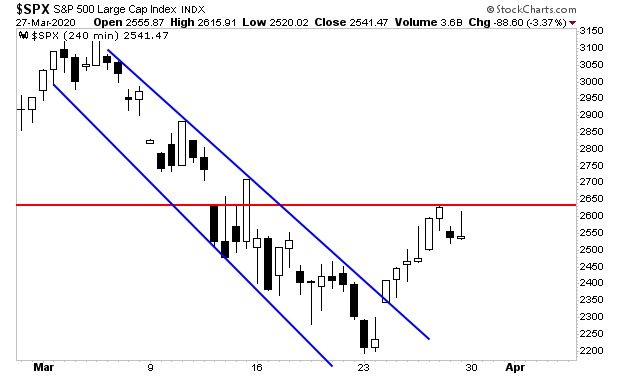

In the simplest of terms, the panic in the markets appears to be abating. It is clear stocks have broken the downtrend from the panic (blue lines). What is not clear is whether this rally will continue or not.

Stocks stalled out under resistance (red line) last week. A break above that line would open the door to a run to 3,000.

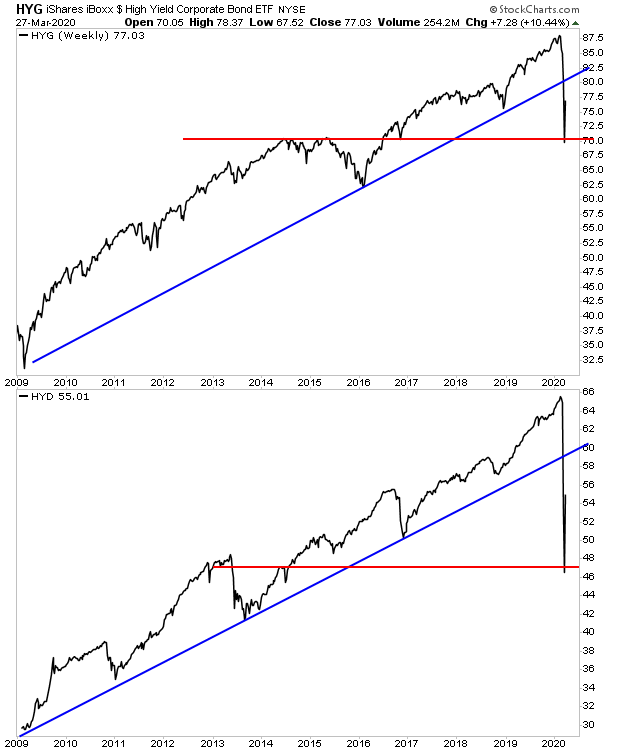

At the end of the day, stocks are actually a minor player in this mess. The BIG story is what happens with the bond markets.

Going into last week, it was clear the financial system was facing a debt crisis. Across the board everything from corporate bonds to municipal bonds were breaking down in a catastrophic fashion.

The Fed managed to stop this massacre by announcing it would backstop everything.

The question now is whether that will be enough. Bonds have staged a major bounce in the last five days, but what happens if they turn down again?

Will the Fed’s announcement that it intends to buy corporate bonds be enough to stop the $10 trillion corporate bond bubble from imploding?

What about the $16-$19 trillion commercial real estate market? Will the shutdown, which has closed so many restaurants and retailers, result in a crisis in this market as businesses begin skipping monthly payments or breaking contracts outright?

And what about the $23 trillion U.S. treasury bubble? Will the $2 trillion in stimulus, which both the President and the Democrats have suggested will be the first of several, be what finally pushes the U.S.’s debt loads into a crisis?

We don’t have answers to any of these questions yet.

The fact stocks have rallied 17% makes investors feel better about things, but it doesn’t do anything to address the larger systemic issues facing the markets today.

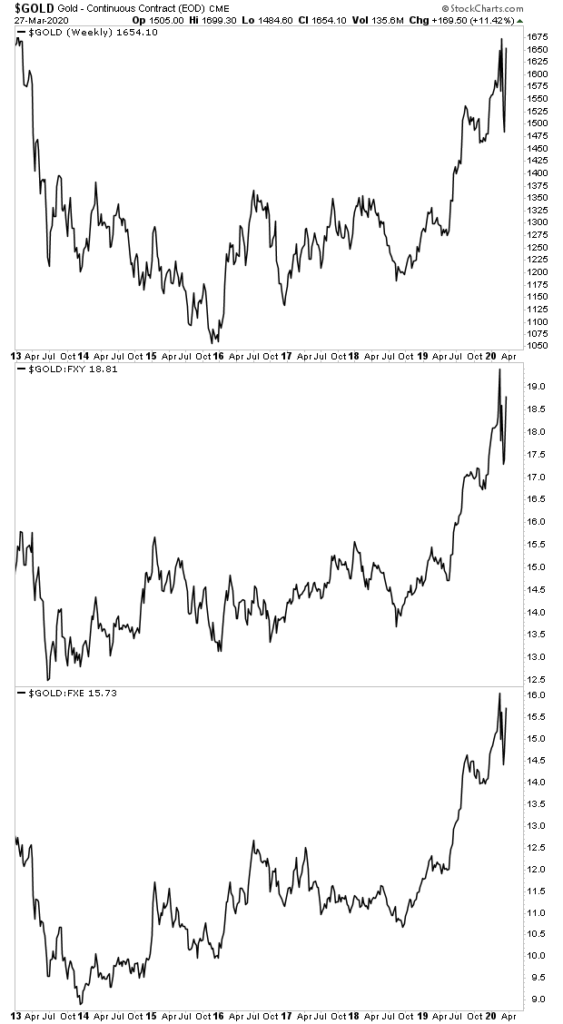

Indeed, the only thing of which we CAN be certain is that the Powers That Be are going to address ALL of these issues by printing money.

And that is going to induce higher inflation.

Note that Gold has broken out against the $USD, the Japanese Yen, and the Euro.

This is telling us that the first round of the crisis, the deflationary collapse, will be ending. But the second round, the INFLATIONARY tidal wave, is only just beginning.

On that note, we just published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU.

We are making just 99 copies available to the public.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research