Stocks exploded higher yesterday on announcements that the coronavirus pandemic appears to be slowing.

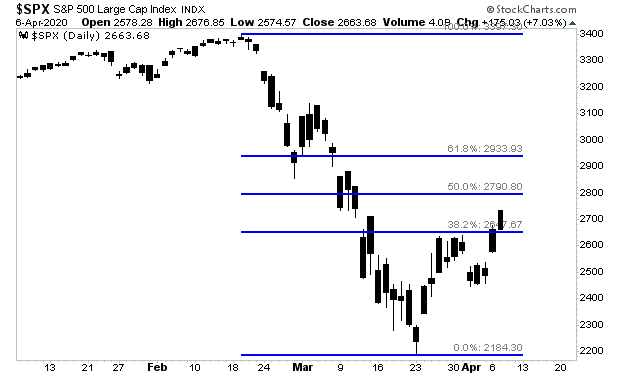

The rally has continued in the overnight session. The S&P 500 will be opening north of 2,700, well above a 38.2% retracement and closing in on a 50% retracement of its collapse.

This is certainly an exciting development, but unfortunately, we are not yet in the all clear as far as systemic problems for the financial markets.

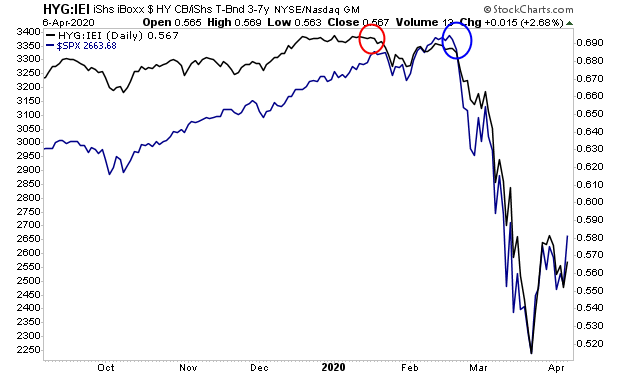

The debt markets (also called credit markets) are larger and more sophisticated than the stock markets.

Indeed, credit picked up on the corona-collapse weeks before stocks did (red circle vs. blue circle in the chart below).

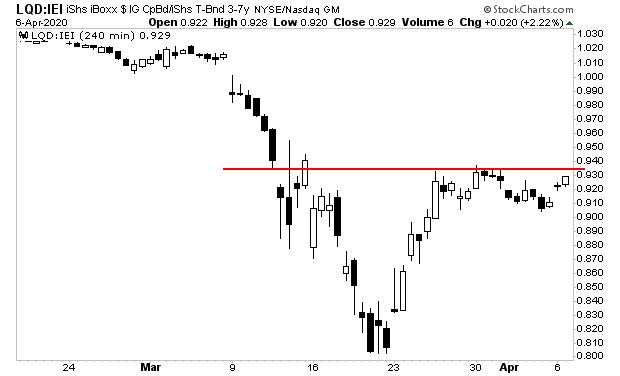

With that in mind, the credit markets continue to signal MAJOR problems exist in the financial system. High yield credit has failed to catch a bid and is in fact trending DOWN during the last week.

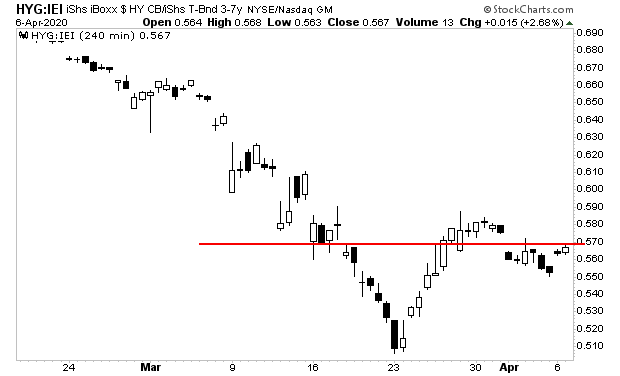

Bear in mind, these are JUNK bonds, so you’d expect a struggle during an economic downturn. Far more worrisome is the fact that high quality credit (meaning credit for companies that are allegedly well financed/less risky) is ALSO struggling.

This is particularly concerning when you consider that the Fed has announced it will be buying these bonds with an unlimited budget.

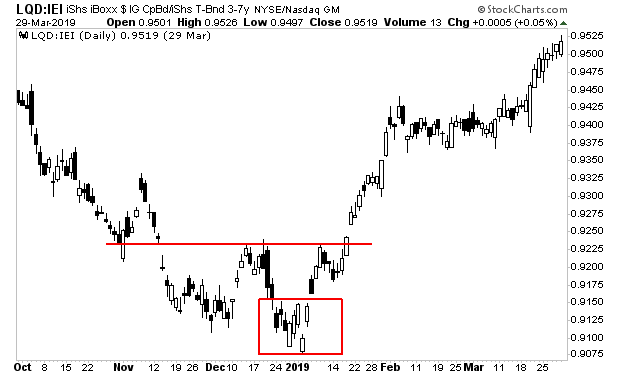

By way of comparison, consider what these credit instruments did during the late 2018-early 2019 “V” bottom which resulted in one of the best years for stocks in history. At that time, investment grade credit only struggled with resistance for a day or two before exploding higher (see the action below the red line in the chart below). And that the Fed WASN’T buying these bonds at that time either!

Again, the credit markets are signaling something BAD is happening “behind the scenes” in the financial system.

Stocks believe the worst is over, but credit tells us that is not yet the case. And credit is usually right.

On that note, if you’re worried about weathering a potential market crash, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

Today is the last day this report will be available to the public.

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best RegardsParagraph

Graham Summers

Chief Market Strategist

Phoenix Capital Research