Let’s focus on price.

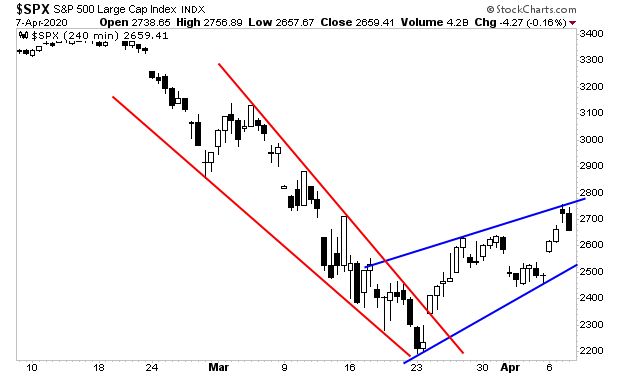

The S&P 500 has clearly broken its downtrend (red lines). It is now bouncing in an uptrend (blue lines). The issue is whether it can continue to do so or if another leg down is coming.

I have no idea which outcome will occur. No one does. So, we need to monitor the financial system for hints of what is to come.

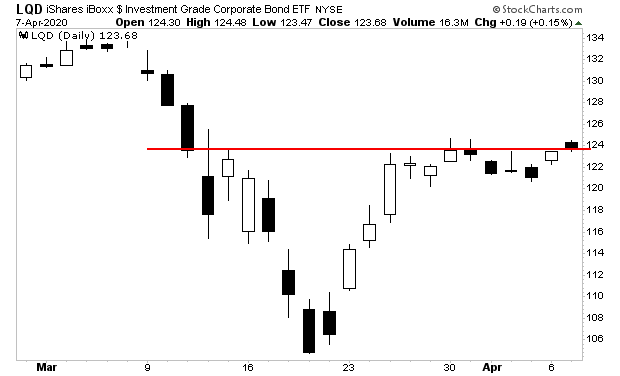

Investment grade credit has broken above resistance. This is good news for the bulls.

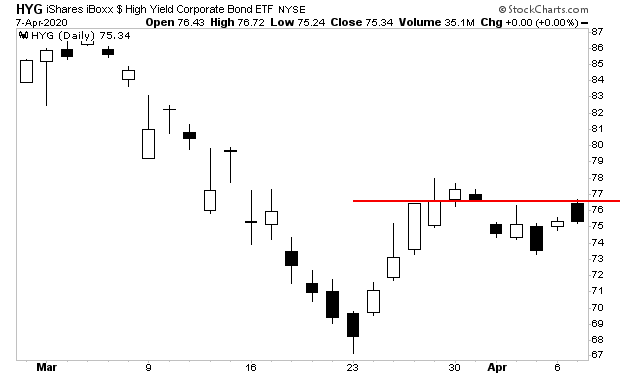

However, high yield credit, which typically leads risk, has broken down below support and is struggling to reclaim it.

This is precisely the kind of confusing action you would expect in a bear market.

Remember, stocks DO NOT rally ~20% in a matter of days during bull markets. These kinds of explosive moves only occur during BEAR markets.

So, while it’s tempting to go long here if you’re a “buy and hold” investor, doing so can be a BIG mistake. Many of the largest most aggressive bear market bounces were soon followed by major drops.

On that note, if you’re worried about weathering a potential market crash, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

Today is the last day this report will be available to the public.

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best RegardsParagraph

Graham Summers

Chief Market Strategist

Phoenix Capital Research