The financial system today is trying to figure out what happens when an unstoppable force meets an immovable object.

The Unstoppable Force= the Everything Bubble bursting as debt markets collapse around.

The Immovable Object= the Federal Reserve and its decision to buy EVERYTHING to stop the panic.

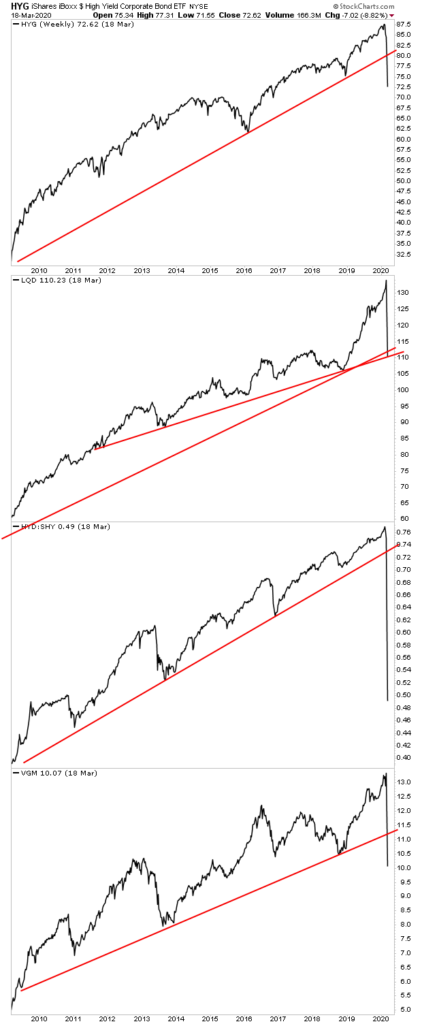

Regarding #1, in March we saw numerous debt bubbles burst including high yield corporate debt, investment grade corporate debt, high yield muni debt, and even investment grade muni debt.

The Fed, in an effort to stop this, announced several weeks ago that it would be buying everything. And I do mean EVERYTHING.

The Fed announced it would:

- Make its quantitative easing (QE) program “unlimited.” Meaning it would simply print money and buy assets ad infinitum.

- Increase the scope of its QE program from simply buying U.S. Treasuries and mortgage backed securities to include:Expand its money market QE to also include a “wider range of securities” including certificates of deposits (CDs).

- Corporate debt (debt issued by corporations).

- Corporate debt-related ETFs (stock funds linked to corporate debt).

- Municipal debt (debt issued by states, counties, and cities).

- Expand its commercial paper QE program.

- Introduce a new QE program to buy any asset-backed security (ABS) including student debt.

- Soon begin a bailout program for small- and medium-sized business.

- Lower the interest rate on its repo programs from 0.15% to LITERAL ZERO (meaning NO interest charged).

Not the Fed was buying everything including CDs, student loans, muni bonds, corporate bonds, etc. As a friend of mine joked, the only thing the Fed wasn’t buying was NFL contracts.

We are now in the process of watching to see if the Fed has succeeded or not. That is… has the Fed’s move to backstop the entire financial system been enough to stop the panic.

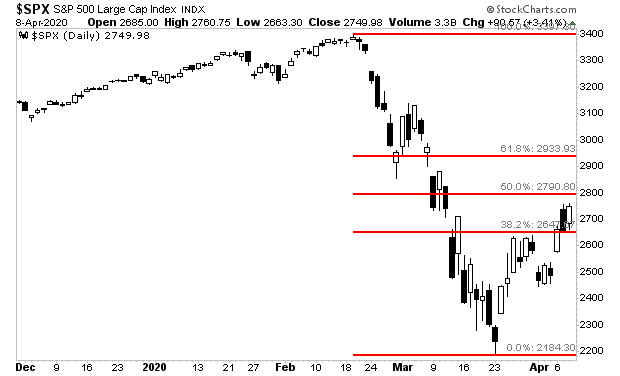

Thus far the answer is a resounding yes. Risk assets are up across the board and stocks are moving to retrace 50% of the initial drop in March.

However, the bigger issue… and it’s the one that may lead to a second round of the crisis is:

What is the actual economic damage caused by the Covid-19 panic and subsequent economic shutdown?

Throwing trillions of dollars at the financial system doesn’t mean that consumer spending is going to come back in a major way.

Cutting interest rates and buying asset backed securities doesn’t make people want to go to restaurants, or go out shopping, or attend sporting events.

Put another way, if the consumer doesn’t come back in a BIG way relatively quickly, then we will indeed find ourselves in a significant prolonged recession.

And that would trigger another round of the financial crisis.

With that in mind, if you’re concerned about how your portfolio might handle a crash,

On that note, if you’re worried about weathering a potential market crash, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

Today is the last day this report will be available to the public.

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best RegardsParagraph

Graham Summers

Chief Market Strategist

Phoenix Capital Research