Last Thursday the Fed effectively nationalized the U.S. debt markets.

On Thursday the Fed announced a $2.3 trillion (with a “T”) monetary program.

In its simplest rendering, the Fed announced it would expand its current Quantitative Easing (QE) programs for municipal bonds, asset backed securities, and investment grade corporate debt. The Fed also announced it would begin buying junk bonds for the first time in history.

Thus, the Fed is now intervening directly in:

1) The Treasury markets.

2) The municipal bond markets.

3) The corporate bond markets (both investment grade and junk).

4) The commercial paper markets (short-term corporate debt market).

5) The asset backed security market (everything from student loans to Certificates of Deposit and more).

At this point the only asset classes the Fed isn’t buying outright via a QE program are stocks and commodities. It is, however, worth noting that the Fed is buying bond Exchange Traded Funds or ETFs which trade on the stock market just like regular stocks.

Again, the Fed has effectively nationalized the U.S. debt markets. All in the span of just six weeks.

It is almost impossible to express the insanity of this. Perhaps the easiest way would be to say the Fed just printed the GDP of Brazil in last six weeks and is planning on printing the GDP of France in the next six weeks.

The multitrillion dollar question now is if this will stop the meltdown triggered by the economic shutdown in the U.S.

Going by the charts right now the answer is “yes.”

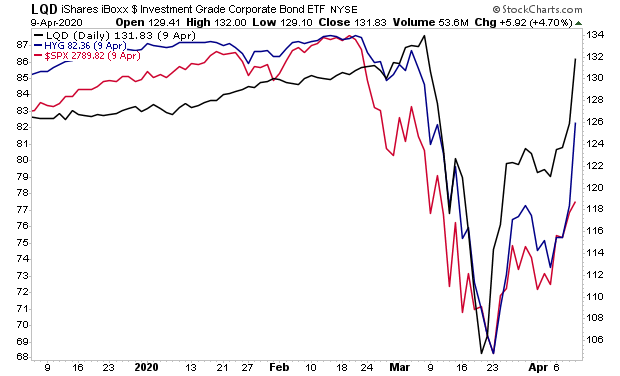

Investment grade bonds (black line), junk bonds blue line) and stocks (red line) are all moving sharply higher. In fact, stocks are actually the weakest performers here, trailing the other two by a wide margin.

However, the bigger issue… and it’s the one that may lead to a second round of the crisis is:

What is the actual economic damage caused by the Covid-19 panic and subsequent economic shutdown?

Throwing trillions of dollars at the financial system doesn’t mean that consumer spending is going to come back in a major way.

Cutting interest rates and buying asset backed securities doesn’t make people want to go to restaurants, or go out shopping, or attend sporting events.

Put another way, if the consumer doesn’t come back in a BIG way relatively quickly, then we will indeed find ourselves in a significant prolonged recession.

And that would trigger another round of the financial crisis.

On that note, if you’re worried about weathering a potential market crash, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

Today is the last day this report will be available to the public.

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best RegardsParagraph

Graham Summers

Chief Market Strategist

Phoenix Capital Research