Stocks are due for a pullback here.

The initial “sugar high” from the Fed throwing trillions of dollars at the financial system is ending. And various ratios I track are suggesting we could have a period of “risk off” or consolidation.

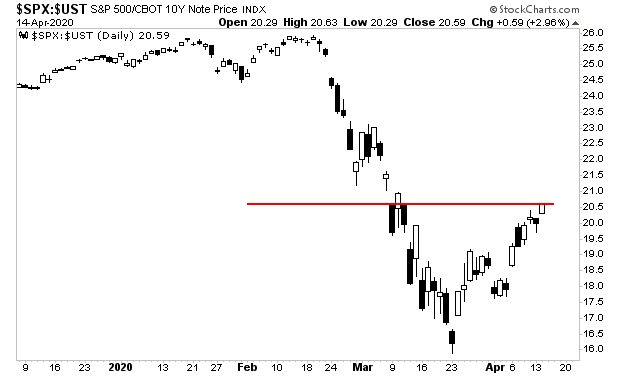

Ratio work consists of comparing one asset class’s performance to that of another. When you do this for a risk asset like stocks, compared to a safe haven like long-term Treasuries, it can provide some insights into whether the financial system is leaning towards risk on or risk off.

The below chart shows the ratio between the S&P 500 and the 10-Year US Treasury. As you can see, this ratio switched from risk off to risk on March 23rd and has since been moving in that direction. However, it is now at resistance.

This would suggest a pullback for this chart, which would mean a period of “risk off” or at the very least a consolidation for the stock market rally.

On that note, if you’re worried about weathering a potential market crash, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

Today is the last day this report will be available to the public.

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best RegardsParagraph

Graham Summers

Chief Market Strategist

Phoenix Capital Research