The rally is now in serious trouble.

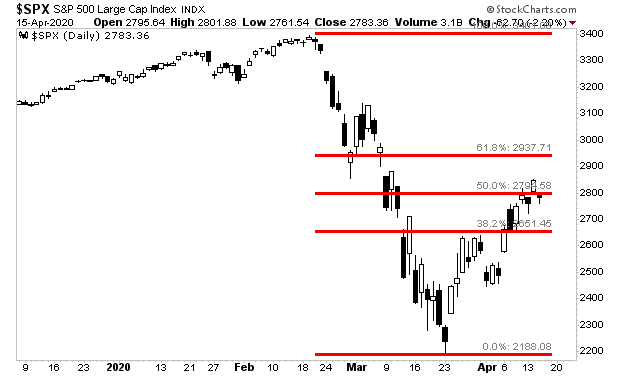

Stocks staged a sharp bounce after the early to mid -arch meltdown. However, they’re running into trouble at the 50% retracement level (2,790 on the S&P 500).

This is bad news. Typically, during a V-recovery in the markets, stocks should have little if any difficulty in tracing 50% of their initial decline.

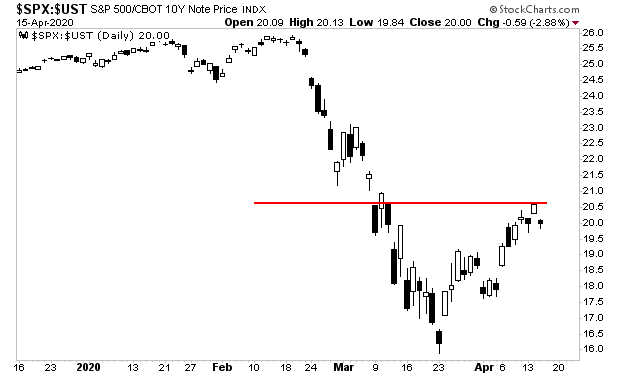

We get a similar warning from the ratio between the S&P 500 and Treasuries. This ratio is struggling at resistance which suggests the system is moving towards a “risk off” environment.

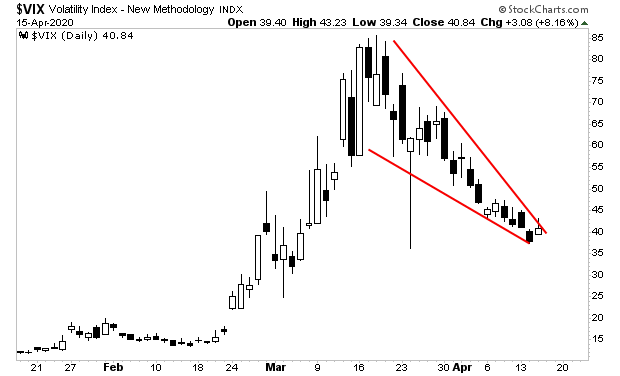

And then there’s the VIX which typically moves higher when stocks collapse. The VIX is forming a bullish falling wedge formation which could resolve in a big move higher.

Add it all up and the financial system is giving us multiple warnings that we could see another sharp drop lower in the markets.

On that note, if you’re worried about weathering a potential market crash, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

Today is the last day this report will be available to the public.

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best RegardsParagraph

Graham Summers

Chief Market Strategist

Phoenix Capital Research