There’s a saying that “in bull markets, stocks don’t sell off on bad news.”

I mention this because the latest jobs data is out and it’s horrific.

Another 4.4. million Americans have filed for unemployment bringing the total the number of unemployed to 26 million.

These are DE-pression type numbers. And yet stocks are holding up despite these numbers.

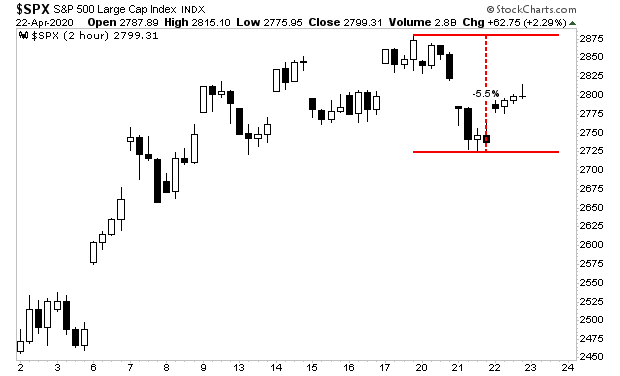

The S&P 500 last peaked on April 17th 2020. Despite a rash of horrific economic data, the index has barely fallen 6%.

As investors, we have to trade the markets as they are… not as we wish they were. And the market is holding up shockingly well given what’s happening in the world.

Remember, “in bull markets, stocks don’t sell off on bad news.”

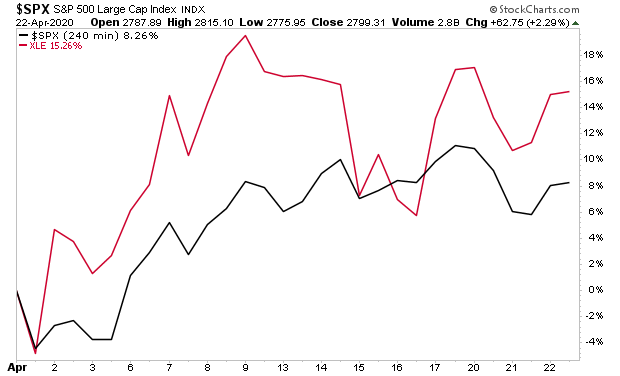

What’s even more shocking is the fact that ENERGY stocks are UP more than the broader market this month.

That’s not a typo, the Energy ETF (XLE) is up 16% while the S&P 500 is up 8% in April. And this is happening at a time when Oil prices dropped to NEGATIVE $40!

This again suggests we are entering a bull market. In bull markets, stocks don’t sell off on bad news. The news lately is horrific, and stocks aren’t selling off.

Graham Summers

Chief Market Strategist

Phoenix Capital Research