“The question is not which woman is the most beautiful but which woman everyone else will think is the most beautiful.”

The man in front of me is a billionaire investor. He is a self-made billionaire. He has actually funded other billionaire investors’ hedge funds. Warren Buffett has publicly admitted that he is one of the few people Buffett “learns from.”

His name is Howard Marks. And suffice to say, I’m all ears.

Marks is discussing the importance of what he calls “second level thinking.”

Second level thinking is being able to think beyond the first level implications of a particular development. Mr. Marks provides several examples of this in his book:

- First-level thinking says, “It’s a good company; let’s buy the stock.” Second-level thinking says, “It’s a good company, but everyone thinks it’s a great company, and it’s not. So the stock’s overrated and overprices; let’s sell.”

- First-level thinking says, “The outlook calls for low growth and rising inflation. Let’s dump our stocks.” Second-level thinking says, “The outlook stinks, but everyone else is selling in panic. Buy!”

- First-level thinking says, “I think the company’s earnings will fall; sell.” Second-level thinking says, “I think the company’s earnings will fall far less than people expect, and the pleasant surprise will lift the stock; buy.”

At the investment conference at the University of Virginia I attended, Mr. Marks gave a more colorful example of “second-level thinking.”

In the early 1900s in the United Kingdom there was a newspaper competition for the most beautiful woman. Readers were asked which woman was the most beautiful out of a series of candidates.

Marks points out that if you picked the woman you thought was the most beautiful you would likely lose the contest. However, if you picked the woman that you believed most readers would think was the most beautiful you would win.

In investing terms, you could rephrase this as:

“You need to overcome your own personal bias and learn to see how the market thinks about things.”

Or as I like to tell my clients: “It’s not what you think, it’s what the market thinks that matters.”

I mention this because stocks rallied yesterday on the announcement that the Bank of Japan (BoJ) would discuss “unlimited bond buying” at its next meeting.

Those of us who track central bank activity are aware that this is something of a bluff. After all, the BoJ has already effectively nationalized its bond market to the point that on some days bonds don’t even trade anymore.

However, what matters is not what we think… what matters is what the markets think. And the markets think central banks will do anything to reflate the financial system.

The key word here is “unlimited.”

In the last six weeks, the Fed, the BoJ and the European Central Bank (ECB) have issued statements saying they are prepared to buy “unlimited” amounts of bonds.

The implications here are:

1) Central banks will buy the bonds governments need to issue to continue financing their massive social spending programs (the stimulus/ welfare/ loans).

2) Central banks will intervene anytime the financial system is in danger of a deflationary collapse.

Put simply, central banks are stating, “we are ready and willing to buy anything with unlimited funds to reflate the financial system.”

Will it work?

It is so far. Stocks have held up reasonably well despite a rash of truly horrific news. In the U.S. there are now 26 million unemployed. According to the U.S. Chamber of Commerce, 54% of small business are believed to have closed during the shutdown. And 24% have stated they are less than 60 days from going out of business permanently.Bear in mind, that information was published April 3rd, so we’re already over 20 days into that 60-day window.

Again, this is horrific, economic DEPRESSION type stuff. And yet stocks refuse to drop. It’s crazy, but again with investing what matters is not what we think… what matters is what the markets think. And the markets think central banks can fix this mess with interventions.

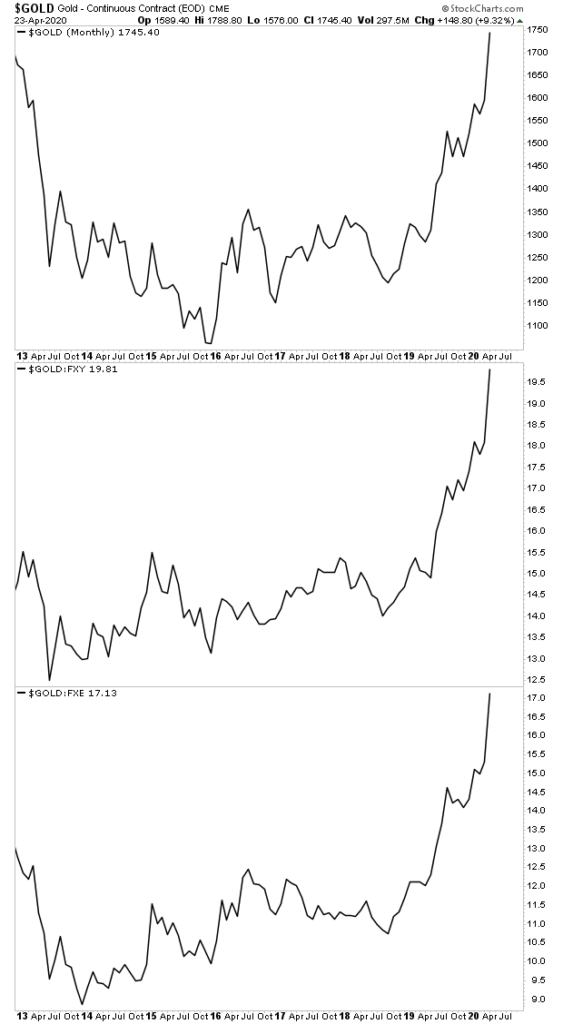

They also believe it is going to unleash and inflationary storm. Gold is breaking out in every major currency.

On that note, we just published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU.

We are making just 100 copies available to the public.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research