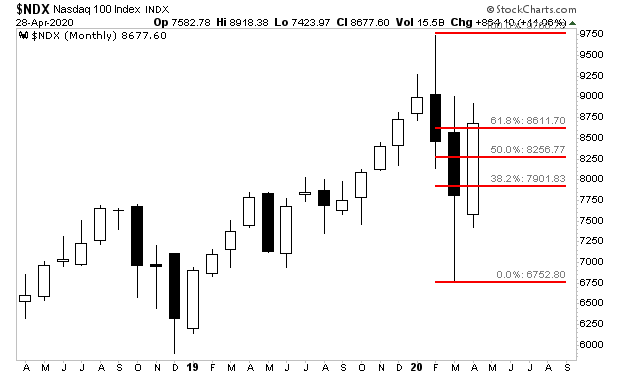

The market is now approaching “the line in the sand.”

That line is the 61.8% retracement of the March meltdown.

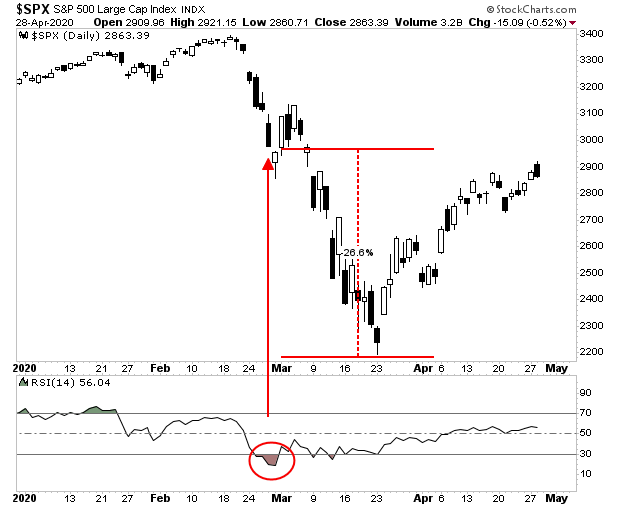

As Bill King has noted, a big problem with major market crashes is that they render most technical metrics useless. Put another way, whenever the market drops violently, things like relative strength, MACD, stop working as trading tools.

Case in point, stocks were already extremely oversold in late February 2020, but they dropped another 26% while RSI flatlined. Anyone who used RSI to try to pick a bottom in late February got destroyed.

For this reason, one of the few technical indicators that remain helpful after a crash are Fibonacci retracements percentages. These are based on the famous Fibonacci ratio (with the exception of the 0.5% which was simply added by traders for its predictive value).

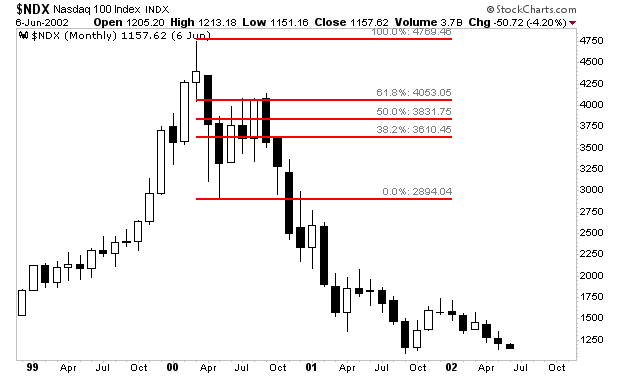

From a predictive standpoint, historically, most major crashes see stocks retrace 61.8% of the initial decline before rolling over and crashing again. Put another way if stocks CANNOT break above the 61.8% retracement, they are doomed to crash to new lows. As such the 61.8% retracement is “the line in the sand.”

————————————————————

Get a LIFETIME Subscription to All Of Our Products For Just $5,000

An annual subscription (1 year) to all of our current newsletters costs $3,500.

But today, you can get a LIFETIME subscription to ALL of them, along with every new product we ever launch, for just $5,000.

Today is the last day this offer is available.

To lock in one of the remaining slots…

———————————————————–

As trader Xtrends has noted, during the Tech Crash the NASDAQ retraced 61.8% of the initial decline during a major bounce. It then stopped on a dime and rolled over to crash to new lows.

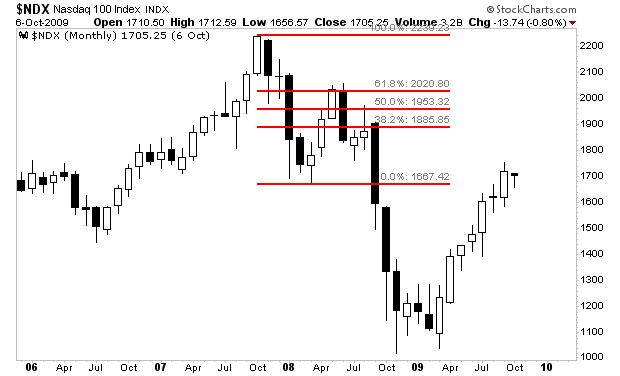

The same thing happened during the 2008 crash.

It’s now in the process of doing the same thing this month. Note that we are slightly above the 61.8% retracement today, but there are still two trading sessions left in the month.

On that note, if you’re worried about weathering a potential market crash, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

Today is the last day this report will be available to the public.

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best RegardsParagraph

Graham Summers

Chief Market Strategist

Phoenix Capital Research