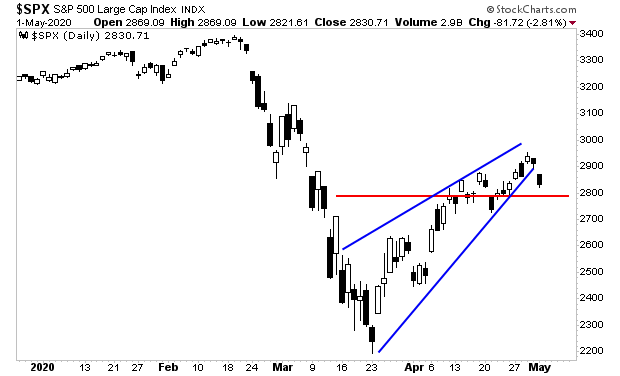

Stocks have fallen to test support.

The rising bearish wedge formation (blue lines) everyone has been tracking broke late last week. The S&P 500 has now fallen to test support (red line).

The bears have jumped on this move, stating that it is evidence we are going to see another crash to retest the lows, or possibly break to new lows. Trading is rarely that easy. If it was, everyone would be a billionaire.

————————————————————

Get a LIFETIME Subscription to All Of Our Products For Just $5,000

An annual subscription (1 year) to all of our current newsletters costs $3,500 (Private WEalth

But today, you can get a LIFETIME subscription to ALL of them, along with every new product we ever launch, for just $5,000.

There are three slots remaining for this offer… don’t miss it.

———————————————————–

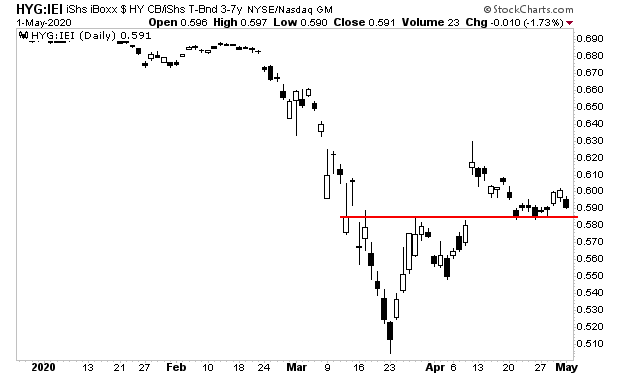

High yield credit, which leads stocks, had been retreating for the last week and a half. It’s important to note that throughout that time, credit never once broke below support.

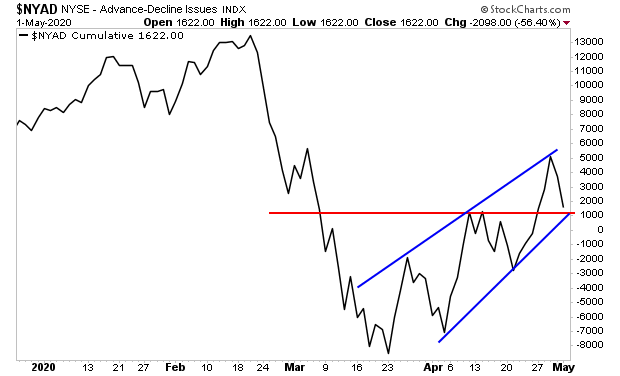

The same is true for breadth, which also leads equities.

Look, I get it… the market bottomed based on massive intervention by the Fed… which makes many investors feel that this bottom is “fake.” However, unless bother credit and breadth break below support, the odds of stocks falling to new lows is next to zero.

These are the charts to watch this week. Don’t get too excited about market action just yet. Let the markets show you what’s coming by breaking key support levels (or holding them) and THEN make your move.

If you’re sick of narratives and want to focus on how to actually make money from the markets, join our FREE e-letter Gains Pains & Capital.

https://gainspainscapital.com/

Graham Summers

Chief Market Strategist

Phoenix Capital Research