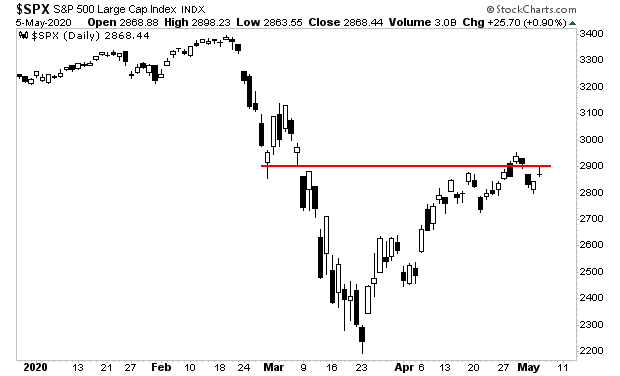

Stocks rallied hard yesterday, but failed to break above resistance (red line in the chart below).

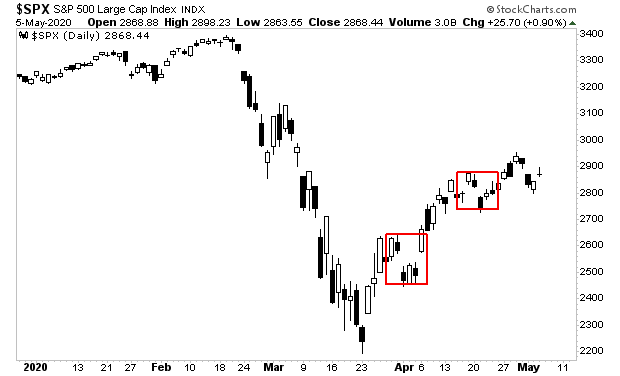

This suggests that the rally is tired and due for consolidation. We have had two similar phases since the markets bottomed on March 31st-April 6th, and April 20th-April 27th (red boxes in the chart below).

The big question for investors is if this is a buying opportunity or the start of a major drop.

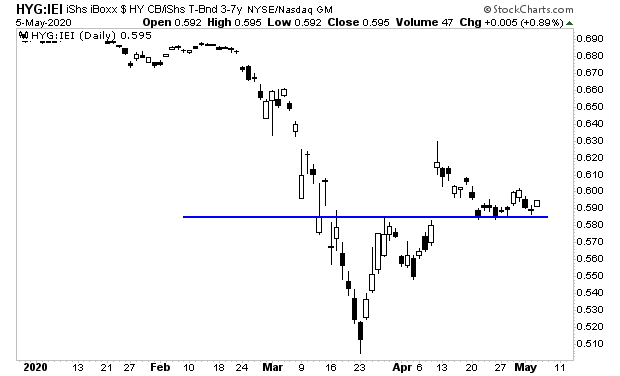

Credit suggests it’s a buying opportunity. As long as high yield credit spreads remain above support (blue line in the chart below), the financial system remains in “risk on” mode.

Outside of stocks, it is clear the elites are planing on introducing extraordinary measures to seize wealth and assets from the middle class.

Consider the following…

The U.S. government intends to issue $3 TRILLION in debt between April and June.

Meanwhile, taxes are collapsing as the economy grinds to a halt… and millions of Americans lose their jobs (ADP reports companies laid off 20 MILLION people in April alone).

So where is the money going to come from to finance all of this insanity?

The IMF is calling for nations around the world to introduce a wealth tax of 10% on NET WEALTH as soon as possible?

If you think that’s bad, consider that the Fed plans to both seize and STEAL savings during the next crisis/ recession.

Indeed, we’ve uncovered a secret document outlining exactly how they will do this.

We detail this paper and outline three investment strategies you can implement right now to protect your capital from the Fed’s sinister plan in our Special Report The Great Global Wealth Grab.

We are making just 100 copies available for FREE the general public.

You can pick up a FREE copy at:

http://phoenixcapitalmarketing.com/GWG.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research