Stocks are exploding higher this morning.

As usual the financial media is looking for a reason for this move. The reason is that stocks had been consolidating for more than two weeks. Lengthy consolidations like this typically resolve themselves in explosive moves.

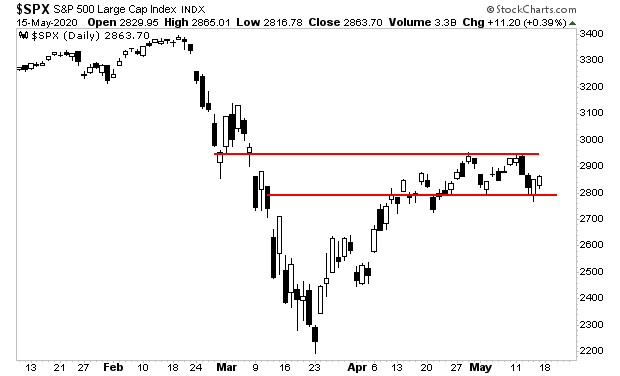

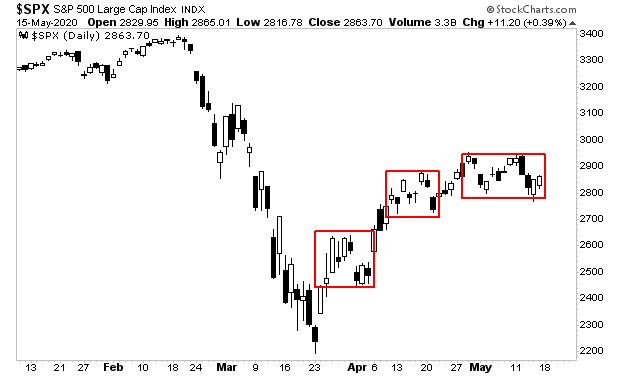

Indeed, as I noted last week, stocks had previously performed two periods of consolidation since the market bottomed March 23rd 2020 (red squares in the chart below). As you can see, each one resolved in an explosive move higher. This third one is no different.

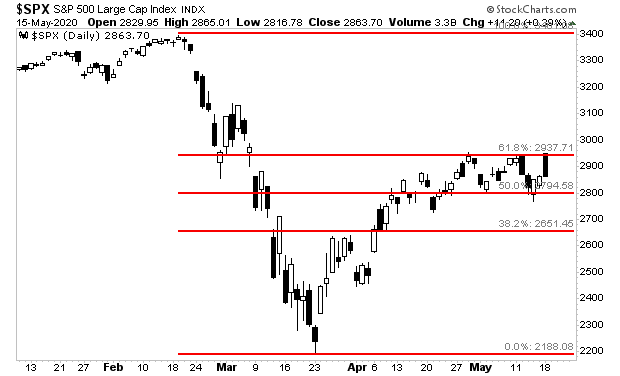

The latest breakout has stock rising to challenge the 61.8% retracement of the March meltdown (roughly the 2,930s).

What happens here is key.

Historically, if stocks are able to break above the 61.8% retracement and stay there, then the rally is no longer considered a bear market bounce but is instead the beginning of a new bull market.

This is the line everyone is watching today.

If stocks can break above this level and hold it, then it will trigger a major flow of new capital into the markets as traders and institutions take this to indicate this is the start of a new bull market.

If you’re sick of narratives and want to focus on how to actually make money from the markets, join our FREE e-letter Gains Pains & Capital.

https://gainspainscapital.com/

Graham Summers

Chief Market Strategist

Phoenix Capital Research