Stocks exploded higher on Friday when it was reported the US unexpectedly ADDED 2.5 million jobs in May (estimates were anticipating a LOSS of eight million).

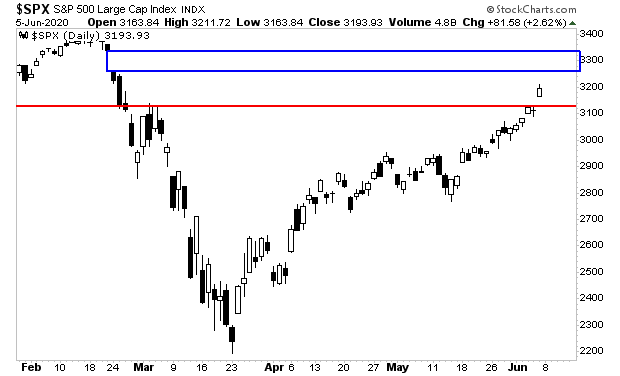

The market blasted through resistance (red line) and is now within 6% of new all-time highs. The question is whether we get a consolidation now, or if traders push stock to “close the gap” just above current levels at 3,270 (blue rectangle in the chart below) this week.

Those are near-term considerations for those of you who are looking for short-term plays. In the bigger picture, the issue to consider is the breakdown in Treasuries.

————————————————————

Get a LIFETIME Subscription to All Of Our Products For Just $2,500

Two annual subscriptions (2 years total) to all of our current newsletters costs $3,500.

But today, you can get a LIFETIME subscription to ALL of them, along with every new product we ever launch, for just $2,500.

There are three slots remaining for this offer… don’t miss it.

———————————————————–

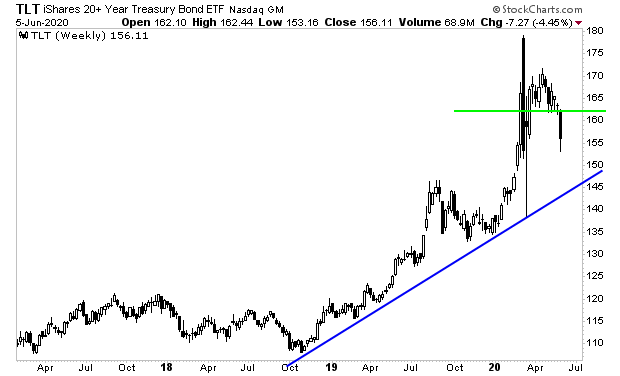

The long-term US Treasury ETF (TLT) has broken below support (green line) in an aggressive drop. There isn’t a whole lot of support until we get to the bull market trendline (blue line).

More and more this is beginning to look like a kind of mini-crash in bonds. Are bonds beginning to discount a much higher rate of inflation in the US? Gold is certainly suggesting this could be the case. The precious metal has broken out in every major currency ($USD, Euro, Yen and Franc).

On that note, we just published a Special Investment Report concerning FIVE contrarian investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU through care investing in the precious metals sector and precious metals mining.

We are making just 100 copies available to the public.

There are just 3 left.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research