The #1 thing investors need to be thinking about today are “unintended consequences.”

Everyone knows that the Fed has flooded the financial system with liquidity. This liquidity, combines with what appears to be a “V” shaped recovery in the economy, is what propelled stocks to go straight up from the March lows.

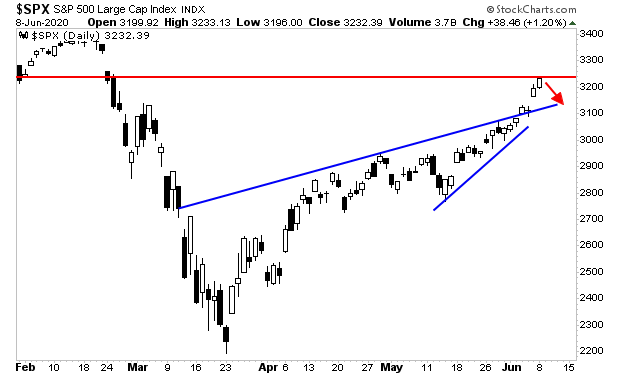

As I write this Tuesday morning, the S&P 500 has broken out of a rising wedge formation (blue lines in the chart below) to the upside. It is now slamming into overhead resistance (red line in the chart below).

It is unlikely we break this on the first try. And a drop to retest the breakout would be perfectly normal. I’ve drawn what this would look like with a red arrow in the chart above.

————————————————————

Get a LIFETIME Subscription to All Of Our Products For Just $2,500

Two annual subscriptions (2 years total) to all of our current newsletters costs $3,500.

But today, you can get a LIFETIME subscription to ALL of them, along with every new product we ever launch, for just $2,500.

The doors close on this offer tonight at midnight.

———————————————————–

So… stocks rally on liquidity as the Fed reflates the system. That’s the obvious consequence of the Fed printed $1 trillion a month. But what is the unintended consequence of this money printing?

The market is suggesting it could be a crash in bonds.

The US was already on schedule to run a $3-$4 trillion deficit this year based on the March-May economic shutdown. However, it is growing clearer that the real number is going to be even higher than that.

Multiple states (NY, CA, IL) are on the brink of insolvency and will need bailouts soon. And the President has suggested he’d like a massive infrastructure bill ($1+ trillion) passed this year as well.

Either of those could mean the US needing to issue $5-$6 trillion in NEW debt this year on top of rolling over old debts. The bond market is signaling this might be too much for it to absorb at current levels.

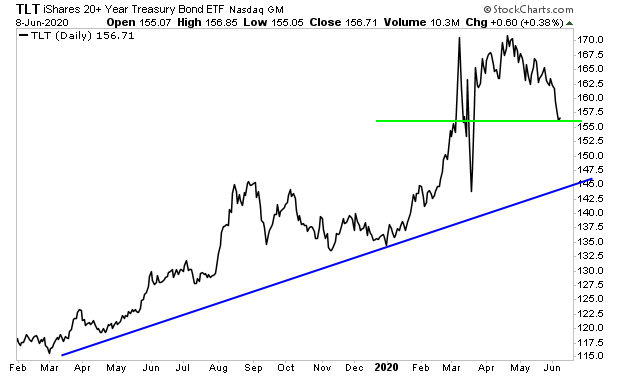

The long-term Treasury has rolled over badly. We are now at support (green line in the chart below) and STILL a long ways from a mean-reversion drop to test the bull market trendline (blue line in the chart below).

A bond crash would mean the bond market revolting against the US’s fiscal stimulus. And it would have a profound impact on ALL risk assets, including stocks.

So while it’s nice to see stocks rallying so much, we need to consider what might be coming down the pike in the near-future. Bonds suggest it’s nothing pretty.

If you’re sick of narratives and want to focus on how to actually make money from the markets, join our FREE e-letter Gains Pains & Capital.

https://gainspainscapital.com/

Graham Summers

Chief Market Strategist

Phoenix Capital Research