The markets are down hard this morning.

There are a myriad of reasons. The most important one concerns price: stocks were extremely overbought and overextended. It was time for a correction.

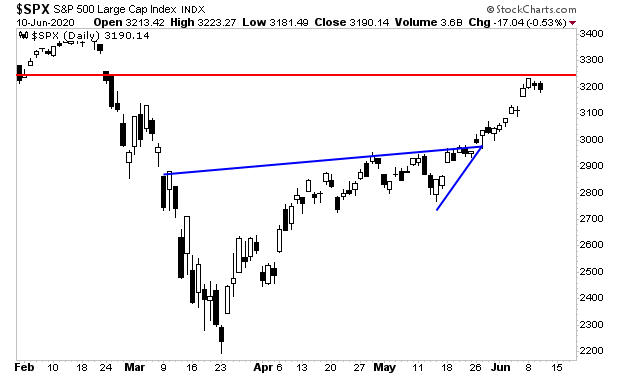

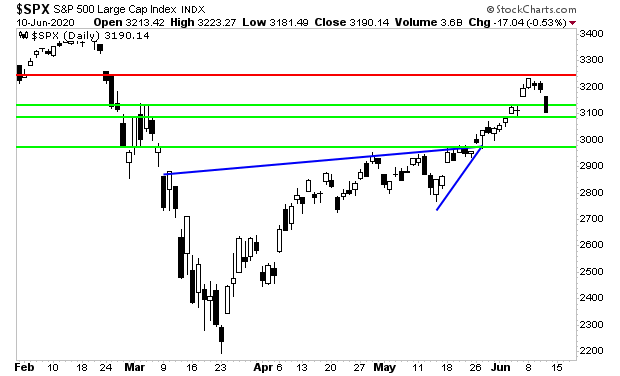

The S&P 500 had just made an explosive move higher out of a rising wedge formation (blue lines in the chart below). This move had brought stocks to a line of major overhead resistance (red line in the chart below).

As I wrote earlier this week, it is highly unlikely stocks would break that red line on the first try. So, a correction is expected here. The question is where it stops.

I’ve drawn the support lines to watch (green lines in the chart below). As I write this, stocks have already sliced through the first and are testing the second.

In the big picture, the fact is that the economic shutdown triggered by the COVID-19 panic has done PROFOUND structural damage to the US economy.

Stocks have largely ignored this, experiencing a kind of “sugar high” by focusing on the record amounts of liquidity the Fed is providing.

However, stocks now appear to be waking up to the damage. We are entering a “risk off” mode in the markets.

In light of this, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

There are only 33 copies available to the public.

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research