Yesterday the U.S. reported its worst ever quarter for economic growth a whopping 9.5% contraction that comes to an annualized pace of 32.9%.

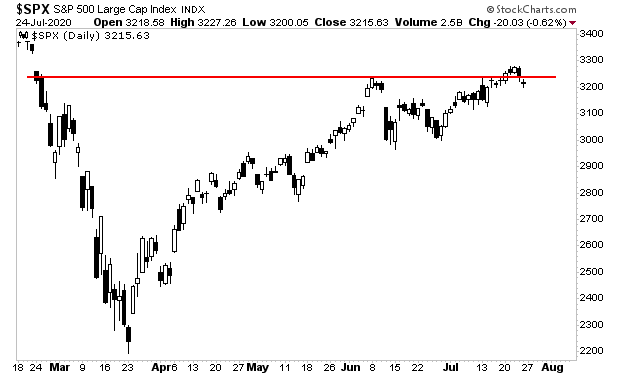

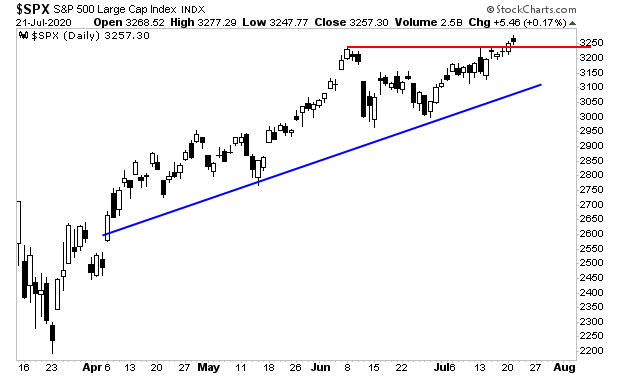

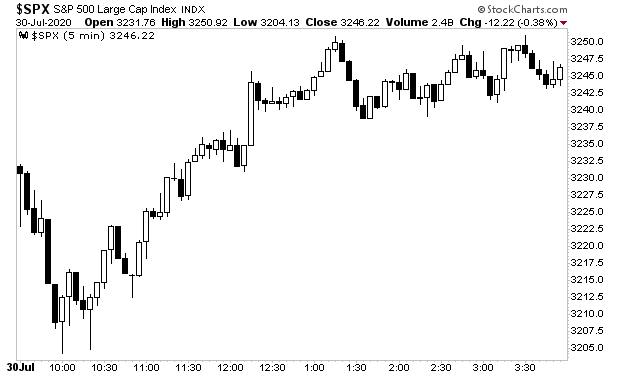

Stocks actually rallied on the news. The S&P 500 bottomed soon after the report was released. It worked its way higher the rest of the day.

This is the kind of thing that drives most investors mad. How can the market go UP on the worst quarterly economic contraction in history?

Because the market is focusing on the future, not the past.

The economy contracted in the second quarter of 2020. We are now in the third quarter. This report concerned what happened in the past. Stocks are looking towards the future.

And the future = a TON of money printing from the Fed.

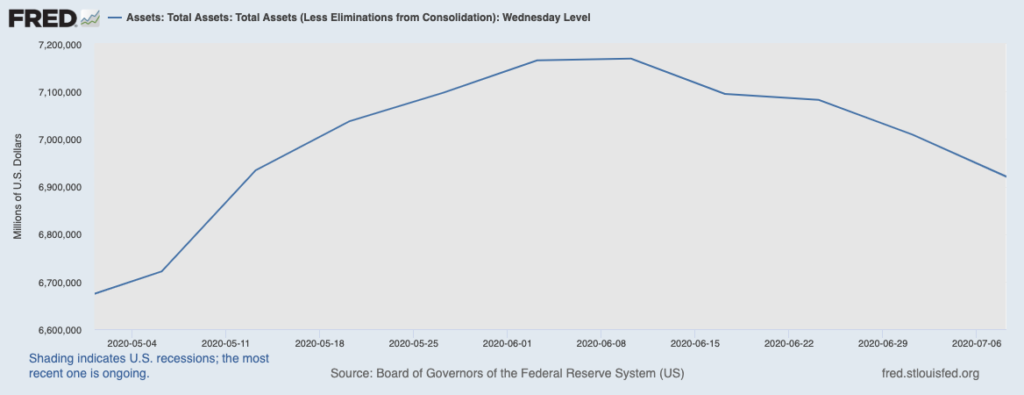

On Wednesday, the Fed announced it will be providing at least $125 billion in liquidity to the markets every month from now until the end of 2021/ early 2022.

Put another way, the Fed has told the financial markets, “we will be providing at least another $2.1 trillion in the next 18 months.”

And we all know that amount would rise dramatically if the markets took a nose-dive.

This is why the markets refuse to fall, no matter how horrible the economic data gets. Because the market is focusing on what the Fed is doing and will do… NOT what the economy has already done.

At the end of the day, it all boils down to what I’ve been saying since 2017… that the Fed is trapped in a vicious cycle through which it INTENTIONALLY creates bubbles to deal with each successive bust.

We had the Tech Bubble in the ’90s.

The Housing Bubble in the mid-00s.

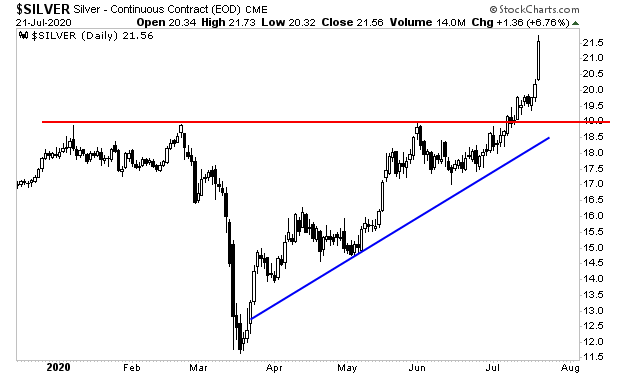

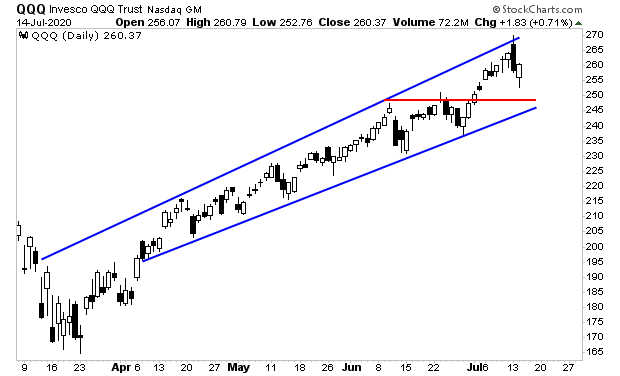

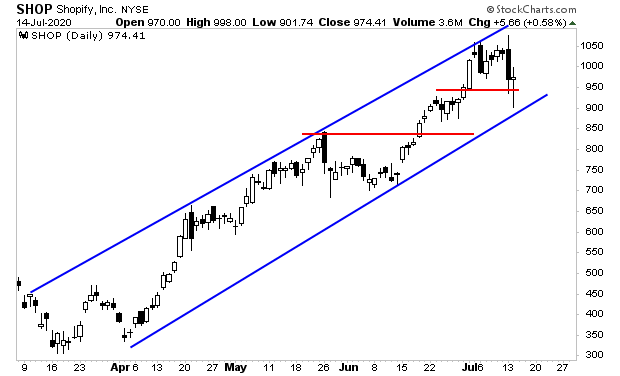

And now the Everything Bubble in 2020.

On that note, we’re putting together an Executive Summary on how to play this move.

It will identify which investments will perform best during the Fed’s next bubble, including a unique play that could more than double the performance of the S&P 500.

This Executive Summary will be available exclusively to subscribers of our Gains Pains & Capital e-letter. To insure you receive a copy when it’s sent out, you can join here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research