The Fed now has a major problem on its hands.

That problem is the fact that gold is ripping higher.

Americans see gold as a measure of inflation. Food prices, car prices, home prices, stock prices, practically the price of anything can rise and the average American won’t think “inflation.”

It’s a different story with gold.

Once gold starts ripping higher to the point that the average American notices it… then everyone and their mother starts talking about inflation getting out of control.

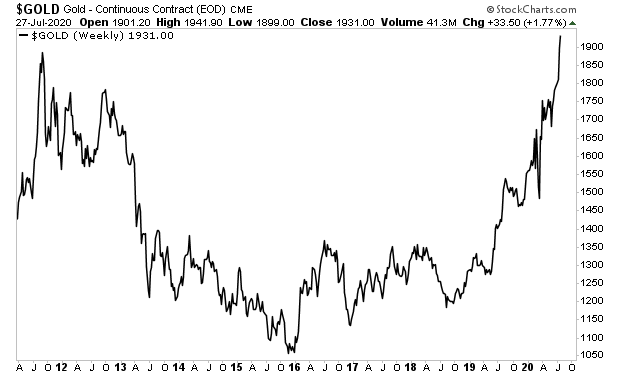

We are at that point now. Gold is going absolutely vertical. And it has just hit new all-time highs, rising almost $500 from its March lows.

This is a signal that the market is “smelling” higher inflation. And because gold is now grabbing headlines, the average American is waking up to this fact.

Which means…

The Fed will now either be forced to confront inflation (hike rates or tighten policy) OR it will begin to lose control.

Tightening monetary policy would mean kicking the already weak economy just as it’s getting back on its feet. This is a guaranteed “depression” trigger and stock market crash.

On the flip side, ignoring gold’s move higher means letting inflation get out of control. Can the Fed afford to let the inflation genie out of the bottle? The last time it did this was in the 1970s, and it didn’t stop until the Fed had raised interest rates to 19%.

This is a literal “no win” situation for the Fed. One choice leads to a depression/ crash. The other leads to stag-flation at best.

Our money is on stag-flation.

We believe the Fed would rather risk letting inflation get out of control rather than triggering a depression. The Fed has always adopted a “kick the can” mentality when it comes to major problems.

Inflation will prove no different. Which is why we believe inflation will continue to spiral out of control in the coming months.

On that note, we just published a Special Investment Report concerning FIVE contrarian investments you can use to make precious metals pay you as inflation rips through the financial system in the months ahead.Paragraph

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU through care investing in the precious metals sector and precious metals mining.

We are making just 100 copies available to the public.

There are just 9 left.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research