The sell-off in precious metals last week barely put a dent in their rally.

As I keep emphasizing, Americans see gold and silver as measures of inflation. Food prices, car prices, home prices, stock prices, practically the price of anything can rise and the average American won’t think “inflation.”

It’s a different story with gold and silver.

Once these precious metals starts ripping higher to the point that the average American notices it… then everyone and their mother starts talking about inflation getting out of control.

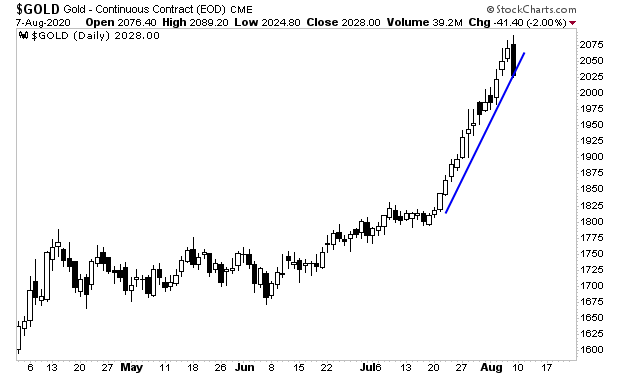

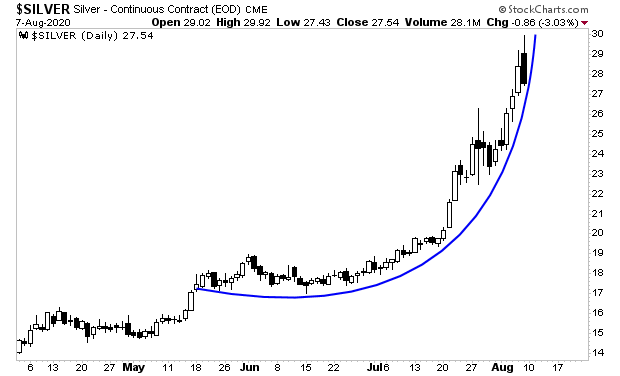

With that in mind, last week’s precious metals sell off barely hurt either metal’s bullish charts.

Gold managed to maintain its near vertical trendline.

Silver didn’t even lose its parabolic arc.

Put simply, both metals are bubbling up.

This the market telling us that it is losing confidence in the Fed. And the bad news is that the Fed likely won’t be able to stop it!

The reality is that the only way the Fed could stop gold’s rise would be to begin tightening monetary policy via interest rate hikes and reducing its Quantitative Easing (QE) program.

The Fed cannot do this without triggering a market crash. As I’ve noted on these pages before, the ONLY thing that stopped the March meltdown was the Fed going nuclear with monetary easing, providing over $3 trillion in liquidity.

Indeed, today the Fed continues to spend over $125 BILLION per month in QE a full three months AFTER the crisis. And the Fed has stated it will continue to do this until there is a full recovery (the Fed believes this will come at the end of 2021).

Put another way, the Fed is trapped. It can either tighten monetary policy and crash the markets, or it can let inflation run wild and gold will go parabolic.

Which one do you think the Fed will choose?

We believe inflation will continue to spiral out of control in the coming months. And gold will hit levels unimaginable to most people.

On that note, we just published a Special Investment Report concerning FIVE contrarian investments you can use to make precious metals pay you as inflation rips through the financial system in the months ahead.Paragraph

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU through care investing in the precious metals sector and precious metals mining.

We are making just 100 copies available to the public.

There are just 9 left.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research