Well, they finally did it.

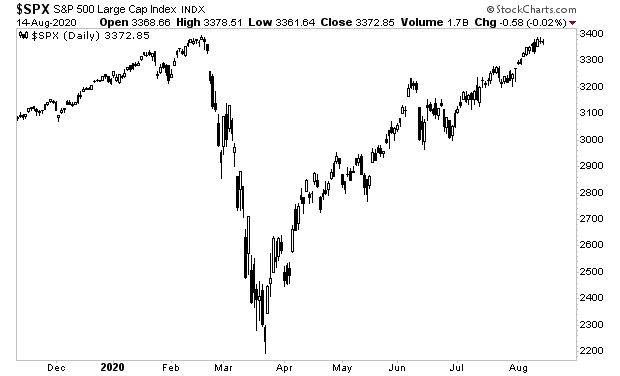

Having thrown over $6 trillion in newly printed money at the financial system, central banks managed to push the stock market to new all-time highs last week.

The S&P 500 broke above its all-time high of 3,393 briefly last week before closing the week down from this level. Emboldened by this, traders will try to push the market to new highs this week on a closing basis.

And why wouldn’t they? Central banks have spent over $6 trillion since the March lows. To put that into perspective, the last time central banks spent this much money, it took them FOUR YEARS (2008-2012). This time around it took FIVE MONTHS (March-July 2020).

Put simply, central banks are “all in” on creating a massive bubble in the stock market.

And they will be using the FANG stocks to do this.

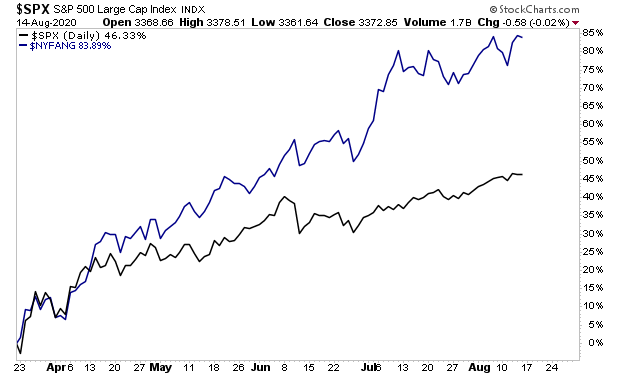

The fact is that since the market bottom, the FANG stocks have done almost all the heavy lifting, holding the rest of the market up for months.

Even with their recent correction, they’ve nearly DOUBLED the performance of the S&P 500 from the March lows.

Put another way, time and again, no matter how overbought they became, the big FANG stocks continue to rally higher and higher, driven by “someone” who seemed hellbent on insuring the market didn’t collapse again.

Why were companies outperforming/rallying so much?

Because the large tech stocks (Microsoft, Apple, Amazon, Facebook) are where central banks are buying.

Together these companies account for nearly 20% of the stock market. And if central banks can get them to rally, the rest of the market will follow.

Put another way, if you were going to rig the market, these are the companies you’d be buying.

And with the same stocks moving higher day after day like clockwork, it’s pretty clear it’s central banks doing the buying.

We know the Swiss National bank buys these companies. And I strongly suspect the Fed is doing it to via some backdoor method.

Regardless of who is doing the buying, “someone” is ramping the market using these companies. And very likely they will continue to do so no matter what.

Regardless of who is doing the buying, “someone” is ramping the market using these companies. And very likely they will continue to do so no matter what.

At the end of the day, it all boils down to what I’ve been saying since 2017… that the Fed and other central banks are trapped in a vicious cycle through which it INTENTIONALLY creates bubbles to deal with each successive bust.

We had the Tech Bubble in the ’90s.

The Housing Bubble in the mid-00s.

And now the Everything Bubble in 2020.

On that note, we’re putting together an Executive Summary on how to play this move.

It will identify which investments will perform best during the Fed’s next bubble, including a unique play that could more than double the performance of the S&P 500.

This Executive Summary will be available exclusively to subscribers of our Gains Pains & Capital e-letter. To insure you receive a copy when it’s sent out, you can join here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research