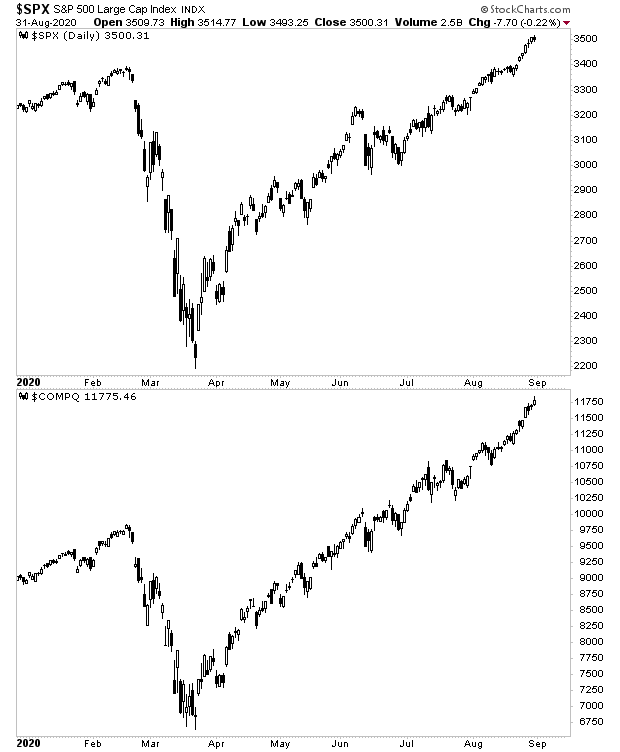

Both the S&P 500 and the NASDAQ hit new all-time highs yesterday.

And why wouldn’t they? After all, the market now realizes what I’ve been saying for months…

The Fed will soon be buying stocks.

After all, the Fed is already intervening in:

- The Treasury markets (US sovereign debt)

- The municipal bond markets (debt issued by states and cities)

- The corporate bond markets by index (debt issued by corporations)

- The corporate bond markets by individual corporate bonds (debt issued specifically by corporations)

- The commercial paper markets (short-term corporate debt market)

- And the asset-backed security markets (everything from student loans to certificates of deposit and more).

It won’t be the first central bank to do so…

The central bank of Switzerland, called the Swiss National Bank has been buying stocks for years. Yes. It literally prints money and buys stocks in the U.S. stock markets.

Then there’s Japan’s central bank, called the Bank of Japan. It also prints money and buys stocks outright. As of March 2019, it owned 80% of Japan’s ETFs.

Yes, 80%.

The BoJ is also a top-10 shareholder in over 50% of the companies that trade on the Japanese stock market.

If you think this can’t happen in the US, think again. The Fed told us in 2019 that it would be forced to engage in EXTREME monetary policies during the next downturn.

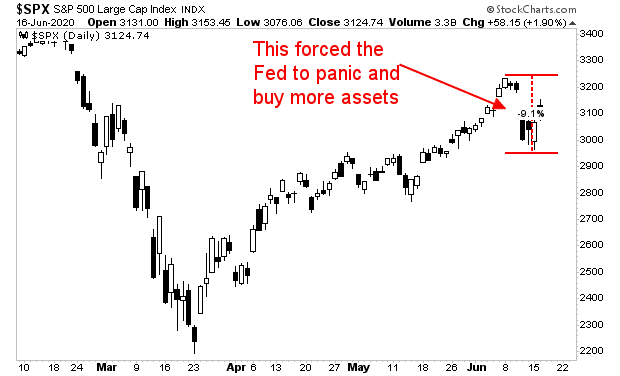

Fast forward to today, and the Fed is doing precisely this. Heck, it can’t even handle a 10% correction without introducing a new monetary scheme back in June… and that was AFTER one of the sharpest rallies in years!

Put another way…

We are now entering the greatest bubble of all time: a situation in which the Fed will spend trillions and trillions of dollars to corner all risk in an effort to reflate the financial system.

As I write this, the Fed has already spent over $3 trillion in the last three months. I expect this will soon be $5 trillion or even $6 trillion before the end of 2021.

At the end of the day, it all boils down to what I’ve been saying since 2017… that the Fed and other central banks are trapped in a vicious cycle through which it INTENTIONALLY creates bubbles to deal with each successive bust.

We had the Tech Bubble in the ’90s.

The Housing Bubble in the mid-00s.

And now the Everything Bubble in 2020.

On that note, we’re putting together an Executive Summary on how to play this move.

It will identify which investments will perform best during the Fed’s next bubble, including a unique play that could more than double the performance of the S&P 500.

This Executive Summary will be available exclusively to subscribers of our Gains Pains & Capital e-letter. To insure you receive a copy when it’s sent out, you can join here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research