Do you have exposure to gold?

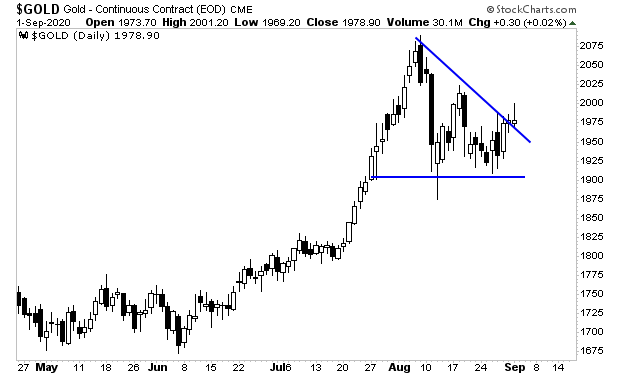

The precious metal has broken to new all-time highs, rising above $2,000 for the first time in history. What’s truly striking however, is that even after such a massive move, gold’s correction was relatively shallow. Indeed, it looks increasingly as if it has put in a base and is ready for is next leg higher.

If history is any guide, we’re just getting started here.

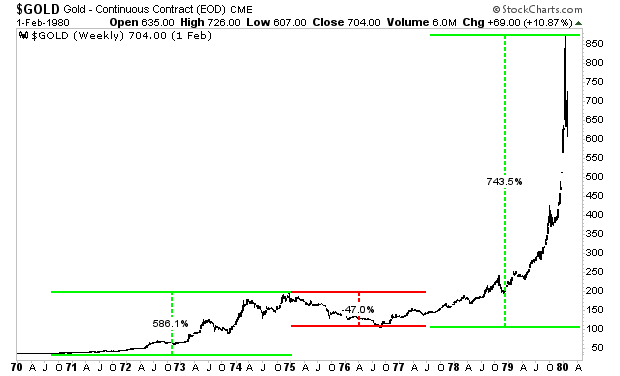

During the last Gold bull market in the 1970s, Gold rose 585% during its first leg up from 1970 to 1975. It then corrected roughly 50% before beginning its next leg up. However, it was the SECOND move higher than was the BIG one= a 740% increase in value.

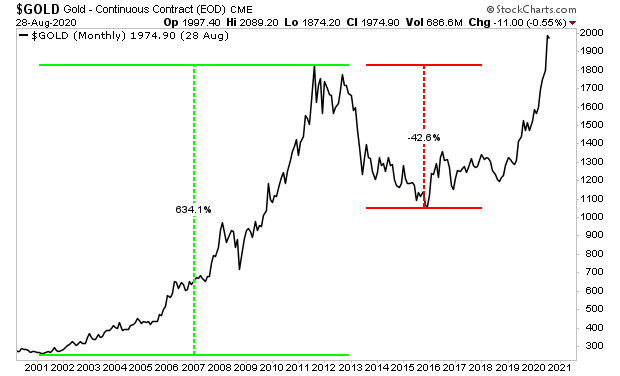

This time around, we’re following a similar pattern. Gold first rallied about 630% from 2003-2011. It then corrected about 43% before bottoming in 2015 at $1,060. If it follows a similar second leg up this time around, it’s going to ~$8,000 per ounce before it peaks.

Literal fortunes will be made by this bull market. And if you don’t have exposure to it, you need to start doing so.

On that note, we just published a Special Investment Report concerning FIVE contrarian investments you can use to make precious metals pay you as inflation rips through the financial system in the months ahead.Paragraph

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU through care investing in the precious metals sector and precious metals mining.

Today is the last day this report will be available to the general public.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research