The Fed is about to intervene in the markets.

The corporate bond market is once again coming under duress. The last two times this happened, the Fed announced a new monetary policy within days.

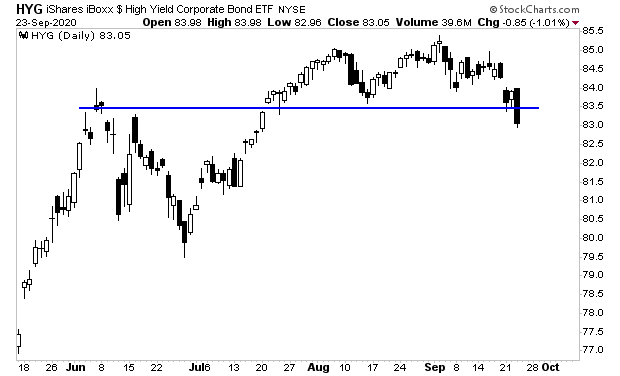

Junk bonds have broken below support.

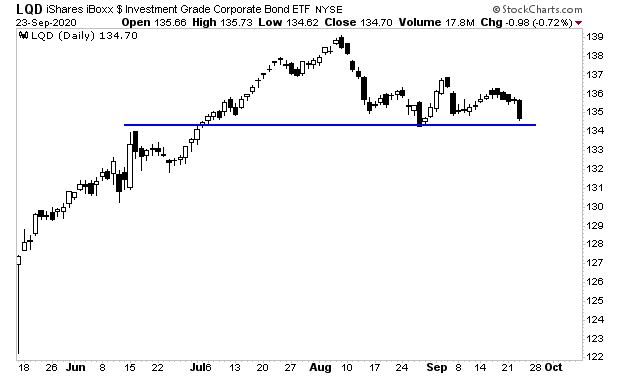

Investment grade bonds are about to do the same.

This indicates that the $10 trillion corporate bond market is coming under duress.

The Fed has spent trillions of dollars propping up this market and other more senior debt instruments. Why would it suddenly decide to let them implode?

So we can expect the Fed to announce a new monetary policy, or at the very least, stage a verbal intervention shortly.

At the end of the day, it all boils down to what I’ve been saying since 2017… that the Fed and US government are trapped in a vicious cycle through which it INTENTIONALLY creates bubbles to deal with each successive bust.

We had the Tech Bubble in the ’90s.

The Housing Bubble in the mid-00s.

And now the Everything Bubble in 2020.

On that note, we’re putting together an Executive Summary on how to play this move.

It will identify which investments will perform best during the Fed’s next bubble, including a unique play that could more than double the performance of the S&P 500.

This Executive Summary will be available exclusively to subscribers of our Gains Pains & Capital e-letter. To insure you receive a copy when it’s sent out, you can join here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research