The U.S. is in very serious trouble.

The integrity of the U.S. election has been damaged, possibly irreparably. There has been clear and obvious fraud. And everyone who isn’t a partisan hack knows it. Regardless of your political views, it is very clear that NONE of this looks appropriate.

In the last five days we’ve seen:

- Multiple states stop counting votes on election night.

- Multiple states find tens of thousands of votes that benefit Joe Biden to a degree that is statistically impossibly.

- Clear examples of dead people voting.

- Counties in which more people voted than were registered.

- States called for Biden when a ridiculously low percentage of votes were counties (Virginia 1%, Arizona 7%, etc.).

Regardless of whether you’re a Democrat or a Republican, you cannot with a straight face say that this doesn’t look suspicious. And that’s putting it mildly.

The bigger issue, outside of who actually wins the election, is the fact that the election system has been compromised. That is a MAJOR problem for the Republic.

And the markets know it.

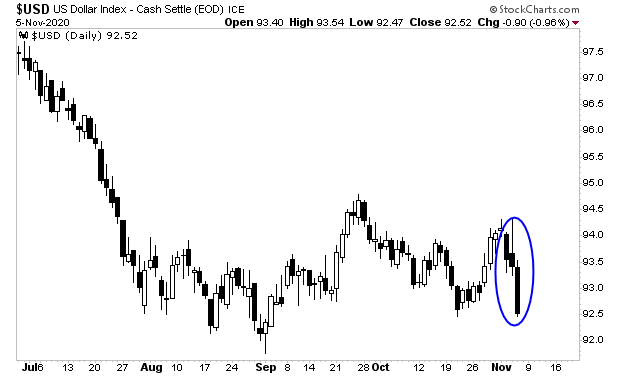

This is why the $USD is rolling over and plunging: capital is reacting to the discovery that the U.S. is now closer to a banana republic than a legitimate first world nation.

That move doesn’t seem like a big deal, unless you understand the significance of the currency markets.

The financial media like to focus on stocks because they are an extremely volatile asset class. This volatility makes stocks seem “sexy” because entire fortunes can be made… or lost… within a matter of weeks.

However, the reality is that stocks are actually one of the smallest asset classes on the planet.

Globally, the stock market is around $80 trillion in size.

That sounds like a huge amount… until you realize that the bond market is more than THREE times this at $244 trillion.

And the currency markets dwarf even the bond markets!

While it’s impossible to know their full size (every currency trade involves two currencies, so the net size is impossible to measure), we do know that the currency markets trade an astonishing $6.6 trillion per day.

To put this into perspective, the New York Stock Exchange – the single largest stock market in the world – typically trades just $200 billion in volume per day.

Put simply, the currency market, based on volume alone, is 33 times larger than the stock market. The U.S. dollar ($USD) is the reserve currency of the world. And the $USD, is the 800-lb gorilla in this market, accounting for over 90% of all currency transactions.

It also accounts for over 60% of all central bank foreign exchange reserves, while nearly 40% of all global debt is denominated in the $USD.

Put simply, the $USD is THE single most important asset in the entire global financial system, the currency of choice for global central banks and global corporations looking to issue debt.

And the $USD is backed by the single largest economy in the world, representing ~25 of global GDP, along with the U.S. military which has a budget equal to that of China, India, Russia, Saudi Arabia, France, Germany, United Kingdom, Japan, South Korea, and Brazil – combined.

Put simply, whatever happens to the $USD will have systemic implications for the world. So, if the $USD is breaking down because the U.S. Presidential election debacle is signaling that the largest economy in the world is becoming a banana republic, it is a VERY bad thing.

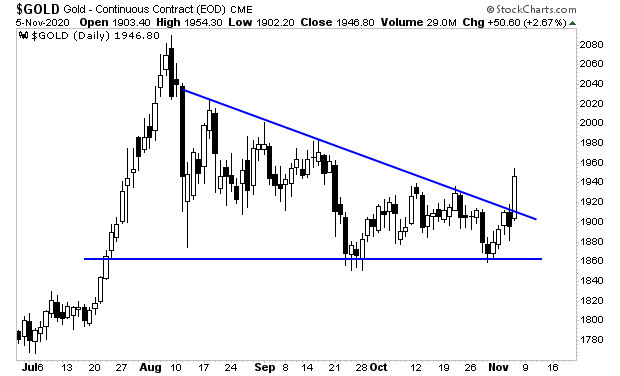

In this environment, everyone should have some exposure to gold. Indeed, it is not surprising that In this environment, everyone should have some exposure to gold. It is not coincidence that the precious metal is EXPLODING higher on this development.In this environment, everyone should have some exposure to gold. Indeed, it is not surprising that

On that note, we just published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU.

We are making just 100 copies available to the public.

As I write this there are just 9 left.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research