Stocks hit a new all-time high yesterday.

The media is trying to attribute this move to Joe Biden picking various people for his cabinet. However, as I’ve stated many times before, Joe Biden has yet to actually win the election. Moreover, the market moves are occurring at totally different times from the announcements of the Biden campaign. So, you can forget this narrative.

What is pushing the market higher?

The Fed and other central

banks.

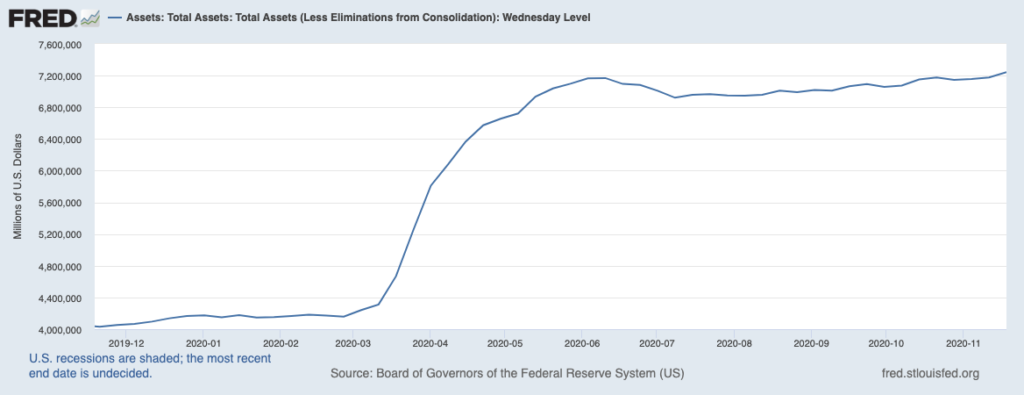

The Fed’s balance sheet exploded by over $60 billion this week, pushing it to new all-time highs of $7.2 trillion.

All told, the Fed has expanded its balance sheet by $3.1 trillion this year.

To put that into perspective, in response to the Great Financial Crisis, the Fed expanded its balance sheet by this same amount over the course of FIVE YEARS from 2008 to… 2013.

Put another way, it took the Fed FIVE YEARS to spend the same amount of money during the worst financial crisis and recession in 80 years. This time around, the Fed spent it in EIGHT MONTHS.

If you want a reason for stocks exploding to new all-time highs over and over again, it’s this TSUNAMI of liquidity the Fed has provided.

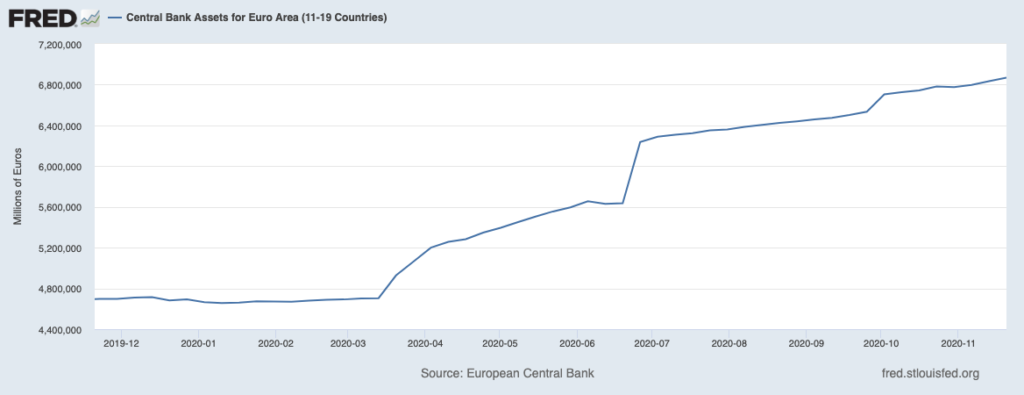

And the Fed is not the only one.

The European Central Bank’s (ECB) balance sheet ALSO hit a new-all time high this week.

Forget Joe Biden or Donald Trump, globally central banks and governments have spent $14 TRILLION this year. We’re talking about an amount of money equal to the GDPs of China (the 2nd largest economy in the world).

That money has to go somewhere. And much of it has gone into stocks, where it is creating the mother of all bubbles.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research