Well, I was wrong.

I had previously written that the election was in the courts and that based on legal precedent, the courts would give President Trump a second term.

The Supreme Court put that notion to rest late on Friday night when it rejected to even hear the case brought by Texas and 18 other states.

It’s pretty staggering if you think about it.

There are sworn affidavits from thousands of poll workers swearing to witnessing fraud. There are vote audits that have turned up fraud. There is statistical analysis that shows fraud. There is historical precedent concerning how key counties and states determine election outcomes that show fraud.

And yet the courts have all either refused to accept any of this evidence… OR refused to even listen to the cases. It’s pretty incredible when you consider just how many ridiculous lawsuits and court cases are heard at all levels of the judiciary, even the Supreme Court.

There are still several cases outstanding as well as political avenues through which President Trump could secure a second term, but those are all EXTREME and likely not worth delving into at this point.

At the end of the day, I was wrong.

I am not in the business of pretending to be psychic, nor do I care for those analysts and pundits who make predictions that don’t prove correct and who then pretend they never made said predictions.

I predicted President Trump would win a second term in the courts. I was wrong. The end.

What matters to us as investors now is how a Biden administration will impact the markets. And by the look of things, the markets love the idea that Biden will packing the Fed and the Treasury with money printers.

The US was already on a trajectory towards hot inflation BEFORE Joe Biden won the election and started enlisting money printers like Janet Yellen to run key positions in his cabinet. Now that we DO have a Biden administration and it is packed with money printers, it’s not a question of IF we get HOT inflation, but WHEN.

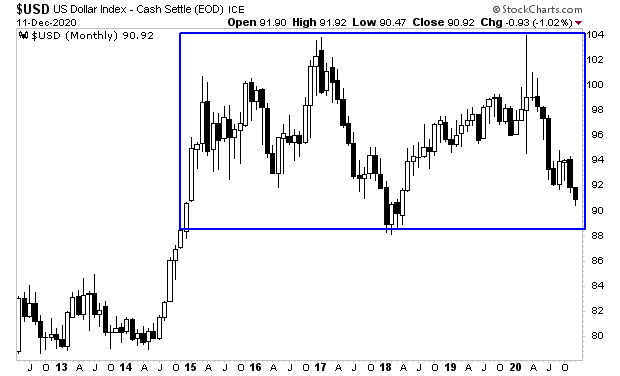

On that note, the $USD has continued to break down in a big way. As I write this, it’s dropping like a stone, again. We are now coming up on MAJOR support in the large consolidation pattern that the $USD has been following since 2015.

A breakdown here, would signal a move into HOT inflation.

On that note, it’s worth pointing out that gold has ERUPTED to new all-time highs priced in EVERY major currency (Dollars, Euros, Yen and Francs).

This is THE big theme for 2021. It is global in nature. And those investors who are well positioned to profit from it could see literal fortunes.

On that note, we just published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU.

We are making just 100 copies available to the public.

As I write this there are just 79 left.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research