The Biden administration has yet to take office, but it already has a MAJOR problem on its hands.

That problem is the U.S. dollar.

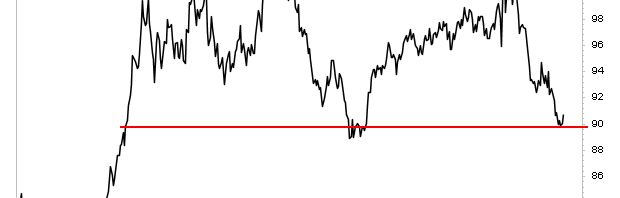

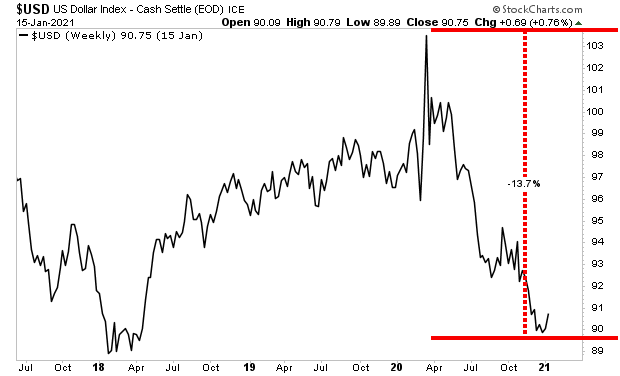

The greenback has declined over 13% since its March 2020. That’s a significant decline to begin with. However, what’s particularly concerning is the fact that the U.S. dollar continues to plunge without ever staging a significant rally.

Put another way, this decline is occurring with little if any breaks.

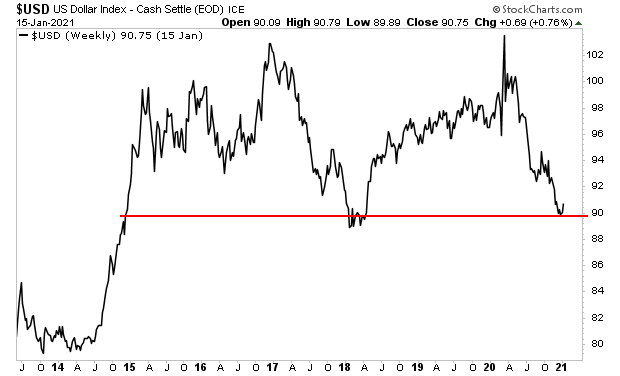

We are currently seeing a dead cat bounce off of CRITICAL support (red line in the chart below). However, once we take out that line, (and we will soon) we’re in VERY serious trouble.

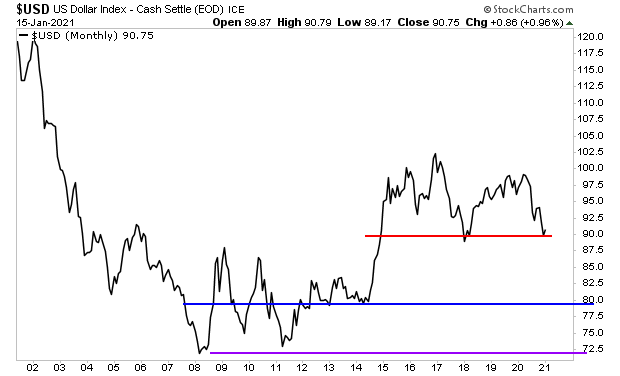

Below this level, there are only TWO lines of support left for the U.S. dollar: support established during the 2012-2014 debt crisis in Europe, and support established by the 2008 crisis.

Put another way, the ONLY time in history that the U.S. doll fell to these levels was when a major Black Swan event was taking place in the global financial system.

Anything below these levels and we are talking about ALL TIME LOWS here for the greenback. Think a U.S. dollar crash.

Bear in mind, this is the situation BEFORE the Biden administration implements its intended $2 trillion stimulus program along with its $2 trillion infrastructure program. Throw in the various climate charge, reparations and other social spending programs that Biden and his allies have been talking about and you’ve got the makings of an inflationary storm.

Those investors who are well positioned to profit from it could see literal fortunes.

On that note, we just published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU.

We are making just 100 copies available to the public.

As I write this there are just 19 left.

To pick up yours, swing by:

https://phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research