Stocks have entered a kind of speculative frenzy.

You’ve no doubt heard or read about Gamestop (GME) the bricks and mortar video game retailer.

The company has been in trouble for months, failing to turn a profit since 2018. And this is happening despite revenues growing.

Because of this, hedge funds have taken MASSIVE short positions in this company, borrowing shares from their brokers to bet that GME’s stock will collapse as the company lurches towards bankruptcy.

How big were the bets against GME’s stock? Well over 100% of the company’s shares are currently being used by shorts.

Yes, short sellers can technically borrow more shares than actually exist. And that’s where the speculative frenzy comes in.

Individual traders,(not institutional traders or hedge funds), who are big fans of GME’s business have launched a campaign to trigger a short squeeze in GME shares.

Remember how I said the short sellers had “borrowed” GME shares? Well, this means that they need to return those borrowed shares to their brokers at some point.

The only way to do this is by buying GME’s stock.

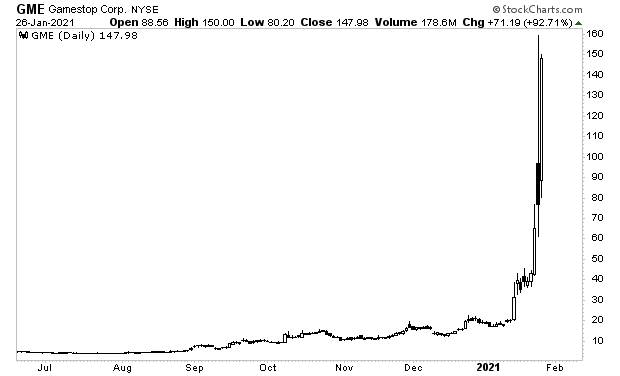

As a result of this, GME shares have gone from $20 to over $200 in pre-market trader today. And they’ve done this in the span of two weeks.

Let’s be clear here, this move has NOTHING to do with GME’s business. This is 100% manipulation being triggered by traders taking advantage of the shorts to ignite an explosive rally.

This tells us one thing…

That for the first time in more than two decades, individual investors are coming back into stocks.

The financial media likes to talk about stocks as though everyone on the planet owns them. It’s true that roughly half of American households have exposure to the stock market, but almost all of this exposure is based on indirect purchases via 401(k)s and other stock-based retirement accounts.

Rarely, if ever, do individual Americans open brokerage accounts and start buying stocks directly.

The last time they did was at the height of the Tech Bubble – the largest stock market bubble in history. A bubble driven by loose money from the Fed and a technology revolution. A bubble that saw individual stocks rising by 25% or even 50% in a single day.

Much like what GME is doing today.

That was the kind of bubble that required individual Americans to get “stock crazy” to the point of opening individual brokerage accounts to start day trading. At the height of the Tech Bubble, a little over one in five Americans were doing this.

And we’re about to see another similar episode.

Yes, this is a bubble and yes it will burst. But for now, it remains intact.

With that in mind, we’ve just published an investment report titled Triple Your Money With the Mother of All Bubbles.

It outlines what the Fed is doing, why it’s doing it, and a unique investment that could easily triple as the Fed unleashes a tsunami of liquidity pushing stocks to nosebleed levels.

The last time the Fed began an easing cycle, this investment rose over 1,439%. And this time around we could see similar gains.

To pick up your copy of Triple Your Money With the Mother of All Bubbles go to:

https://www.phoenixcapitalmarketing.com/MOAB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research