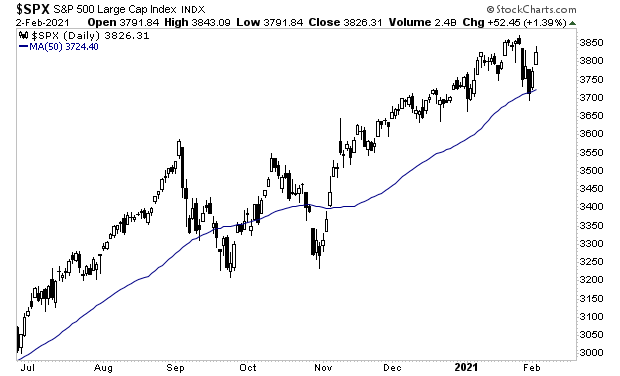

As I forecast to clients in last week’s Private Wealth Advisory, stocks have bounced hard off the 50-day moving average.

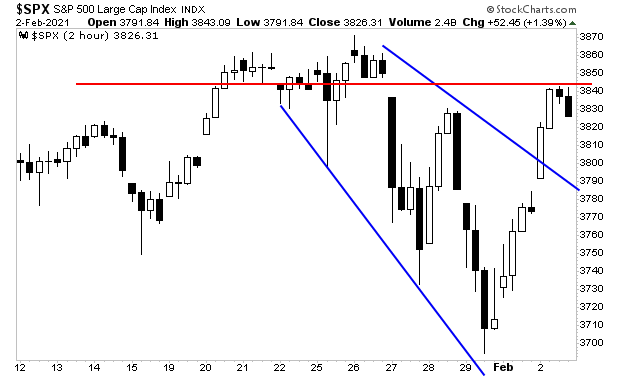

The bounce consisted of a clear breakout from the downward channel formed by last week’s correction (blue lines). As I write this, stocks have been rejected at resistance (red line in the chart below) and are sitting just below their all-time highs.

I expect we’ll see that line of resistance broken shortly.

Why?

Because the market is returning to “business as usual.”

The primary concern for the stock market last week was whether or not Wall Street remained in control of the financial system. Put another way, would the Gamestop (GME) phenomenon through which thousands of individual investors intentionally pushed a stock higher to hurt a hedge fund, would become the norm.

With the regulators cracking down on the GME scheme, it is clear that Wall Street has won this round.

I’m NOT saying that I like this situation, I’m simply saying that it is clear that the individual investors will not end up winning this war (how can they with Wall Street having the regulators, government and entire system covering for them?).

Put simply, the craziness of GME is subsiding and the system appears to be returning to “business as usual.” This is what the large pools of capital were looking for in order to start buying again.

And buy they shall. After all, their compensations depend on it.

On that note, we just published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU.

We are making just 100 copies available to the public.

As I write this there are just 17 left.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research