The bloodbath continues.

I warned for weeks that inflation was going to annihilate investors portfolios. And now it is.

The big question for most investors, is “when does it end?”

No one knows. But the market is offering us some clues.

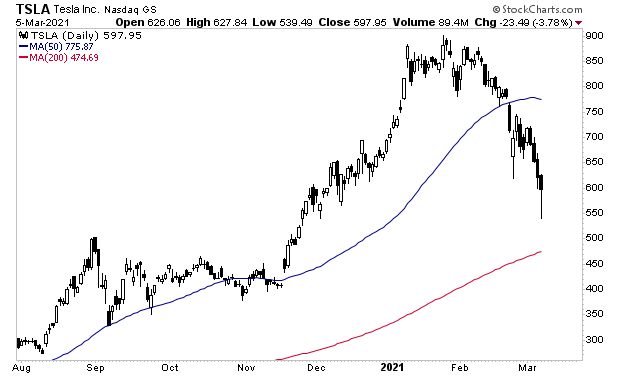

Tesla (TSLA) was one of the hottest momentum stocks on the market going into this meltdown. It has sliced right through its 50-DMA and is now approaching its 200-DMA. Realistically, the 200-DMA is the first place we could see an actual bottom formed.

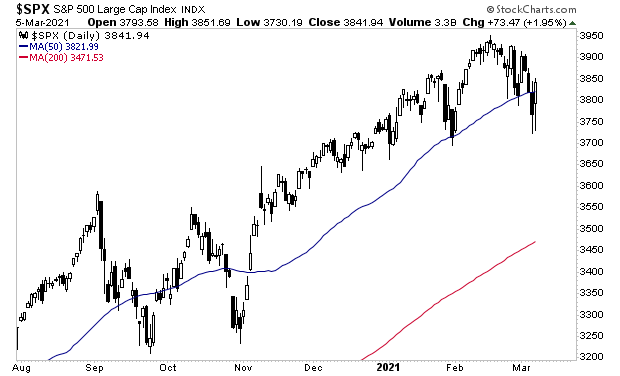

If the overall market were to follow TSLA, this would mean the S&P 500 dropping to roughly 3,500.

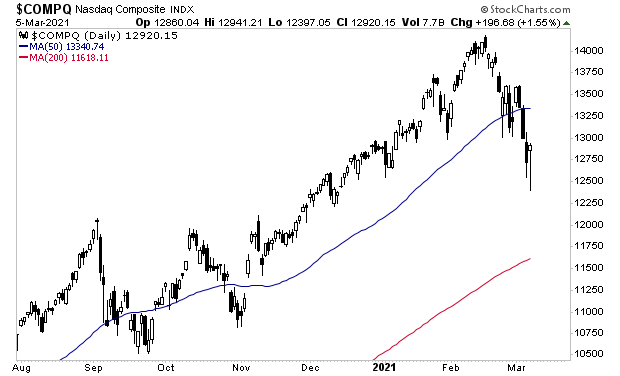

And the NASDAQ falling to 11,600 or so.

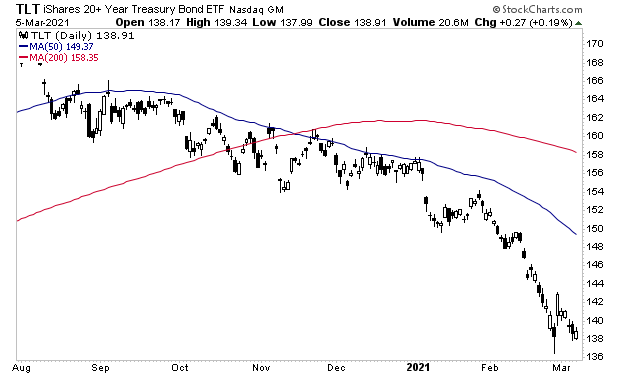

I know this is NOT what you wanted to hear. But the reality is that as awful as last week’s selling was, it didn’t induce any major flight to safety in bonds.

Historically, Treasuries are a safe haven, meaning that during times of trouble, capital runs to them for safety. However, last week this didn’t prove to be the case. The long-Treasury ETF (TLT) briefly spiked for a day or so, but then plunged back down to its lows.

Until you see TLT rallying hard, the odds of a market bottom remain extremely low. I wouldn’t get too excited about buying stocks until we see TLT trading near its 50-DMA at 148 or so.

Which means, buckle up, because the market is STILL in serious trouble.

Those who are properly prepared. however, will make literal fortunes.

On that note, if you’re worried about weathering a potential market crash, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

We are making just 100 copies available to the public.

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best RegardsParagraph

Graham Summers

Chief Market Strategist

Phoenix Capital Research