Stocks are bouncing hard this morning because China stepped in to prop up its stock market.

That’s it. That’s the only reason.

Put another way, the stock market is in very serious trouble.

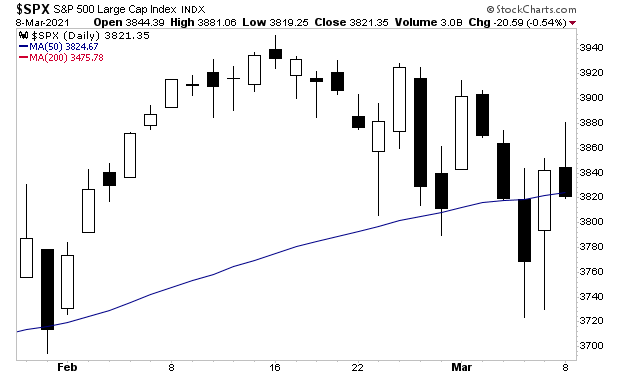

The bulls have made multiple attempts to keep the S&P 500 above its 50-day moving average (DMA). Despite all of their efforts, the S&P 500 still closed below the 50-DMA yesterday.

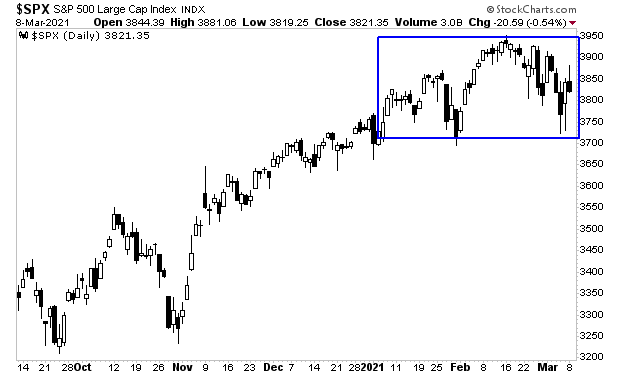

The longer-term picture isn’t much better. The S&P 500 has effectively traded sideways now for three months. Stocks have managed to move a lot without actually going anywhere!

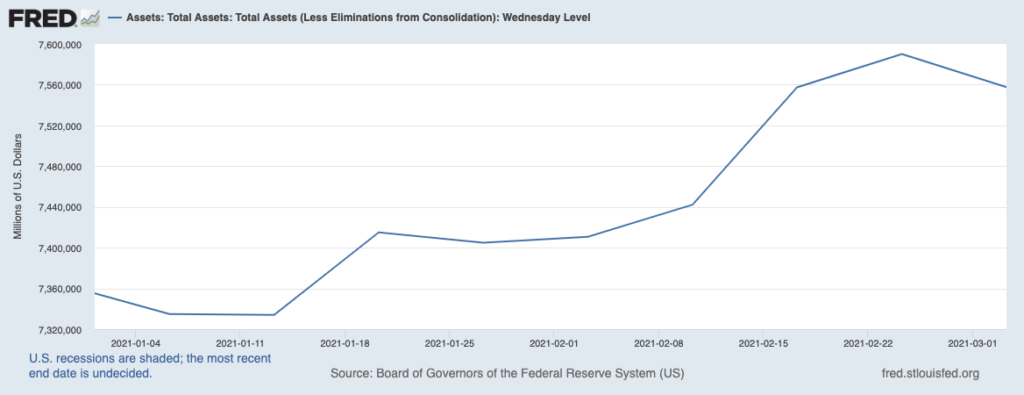

Mind you, this is happening at a time when the Fed is pushing some $120 BILLION into the financial system every month. So, the market has managed to go nowhere despite the Fed putting nearly a quarter of a trillion dollars into the financial system ($120 billion for January and February each).

Now you understand why I say the markets are in serious trouble. It stocks can’t catch a bid despite this much money printing, something is VERY wrong.

That something is inflation.

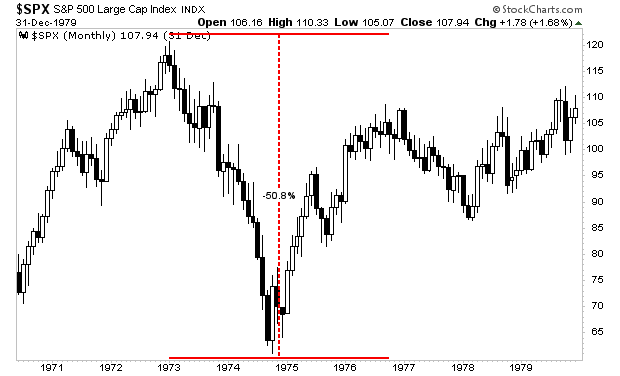

Stocks love inflation at first, but that love quickly turns to hate. During the last bout of hot inflation in the 1970s, stocks initially bubbled up before CRASHING nearly 50% in the span of two years, wiping out ALL of their initial gains and then some.

As I keep warning, inflation is going to ANNIHILATE investors’ portfolios.

Those who are properly prepared. however, will make literal fortunes.

On that note, if you’re worried about weathering a potential market crash, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

We are making just 100 copies available to the public.

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best RegardsParagraph

Graham Summers

Chief Market Strategist

Phoenix Capital Research