Yesterday, I outlined how the rise in inflation has slammed Tech stocks lower.

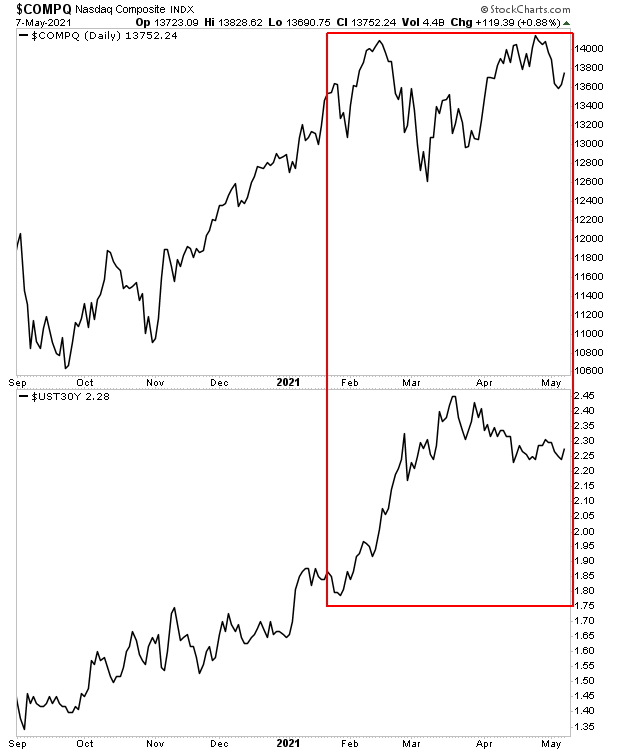

By way of a quick review, Tech, as represented by the NASDAQ is highly sensitive to inflation on an inverse relationship: when inflation rises, Tech stocks collapse and when inflation falls, Tech stocks erupt higher.

The reason for this is that much of Tech investing is based on growth rates. And if bond yields rise as a result of inflation, bonds become more attractive as an investment, taking away from the appeal of Tech.

As I noted yesterday. as inflation entered the financial system in 2020 and began to accelerate in 2021, Tech stocks have struggled. You can see this in the chart below (red rectangle).

So, we know that Tech is going to struggle going forward as inflation heats up. But what about the broader market like the S&P 500? Will it collapse too?

To figure that out, let’s take a look at the last two inflationary scares in the U.S.

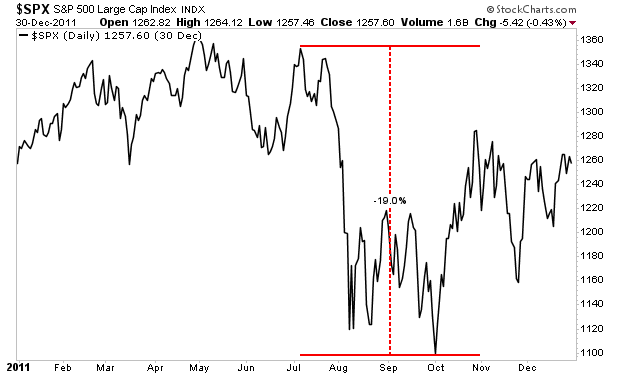

The most recent scare occurred in 2010-2011. At that time, the Fed was pretty quick on the uptake and decided to allow its QE 2 program (the cause of the inflationary spike) to end.

The Fed then waited several months before introducing any new monetary programs. And when it did introduce one, it didn’t involve money printing (instead the Fed used the proceeds from Treasury sales to buy long-date Treasuries through a process called Operation Twist). This was a kind of stealth tightening.

Stocks didn’t like this, collapsing nearly 20%.

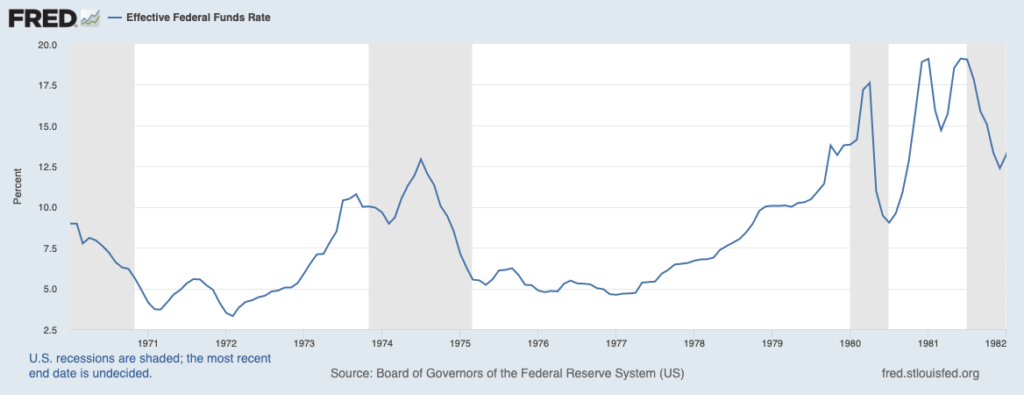

Bear in mind, that was a relatively minor inflationary scare. During the last legitimate inflationary storm in the 1970s-1980s.

During that mess, the Fed was forced to be MUCH more aggressive with its tightening, embarking on two aggressive tightening schedules. It’s worth noting that this triggered two SEVERE recessions (shaded areas).

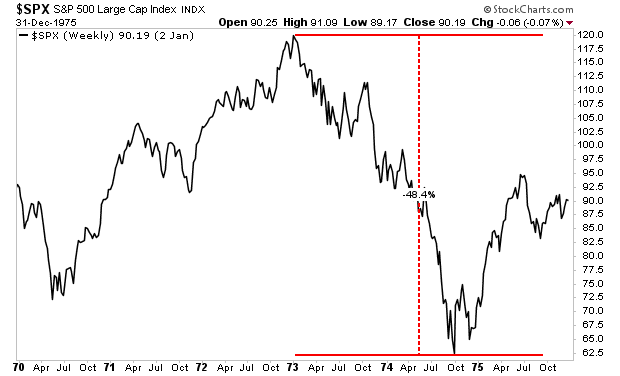

This IMPLODED the stock market, resulting in a roughly 50% decline over the course of 18 months.

So, what will it be this time? Will the Fed engage in a stealth taper as was the case in 2011… or will it tighten monetary policy aggressively as it did in the 1970s and 1980s?

We’ll address that in our next article.

in the meantime, we just published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU.

We are making just 100 copies available to the public.

To pick up yours, swing by:

https://phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research