Yesterday I outlined why I believe most crypto-currencies will eventually prove worthless.

By way of quick review, crypto is a tech asset. And all technological revolutions follow two phases:

- The initial breakthrough phase, which occurs before social/legal frameworks are in place.

- The “normalization” phase during which social/legal frameworks are implemented giving the technology a societal and financial legitimacy.

If you need a real-world example of this, think of the electronic music file or MP3 revolution. The first phase was Napster, which featured the sharing of music in what was later deemed as illegal activity (the legal framework was not yet ready for the technology).

Then along came iTunes: the normalized version of the technology in which MP3s could be bought and sold in a legally acceptable form.

I believe bitcoin and crypto currencies are currently in the Napster phase of their development. And the Fed will soon introduce “iTunes.”

We know that as far back as 2017, the Fed was already studying this issue:

As the price of the cryptocurrency continues to soar, the Federal Reserve apparently is giving thought to having a product like bitcoin for its own.

William Dudley, president and CEO of the Federal Reserve Bank of New York, said at a conference Wednesday that the Fed is exploring the idea of its own digital currency, according to reports from Dow Jones.

Any product likely would be well off in the future, he said, adding that it would be “very premature” to estimate when the Fed would come up with its own offering, according to Bloomberg.

Source: CNBC

More recently, on February 5th 2020, Lael Brainard who sits on the Federal Reserve’s Board of Governors, which is in charge of establishing Fed policy, stated the following:

In a Bank for International Settlements survey of 66 central banks, more than 80 percent of central banks report being engaged in some type of central bank digital currency (CBDC) work.12 … a few central banks report that they are moving forward with issuing a CBDC. Building on the tremendous reach of its mobile payments platforms, China is reported to be moving ahead rapidly on plans to issue a digital currency.13

Given the dollar’s important role, it is essential that we remain on the frontier of research and policy development regarding CBDC… we are conducting research and experimentation related to distributed ledger technologies and their potential use case for digital currencies, including the potential for a CBDC. We are collaborating with other central banks as we advance our understanding of central bank digital currencies.

https://www.federalreserve.gov/newsevents/speech/brainard20200205a.htm

Here is a senior member of the Fed stating point blank that the Fed needs to introduce a central bank digital currency (CBDC) in order to maintain the geopolitical standing of the U.S. dollar. The fact she mentions this RIGHT after discussing the fact China is moving forward with a sovereign digital currency tells us that this is a matter of national security for the U.S.

And then just this week, Fed Chair Jerome Powell commented that crypto currencies are “not convenient for payment” due to swings in value. He added that the Fed will issue a report on U.S. digital currency this summer.

Look, it’s obvious what the Fed is doing here. China has already launched a pilot version of the digital yuan. Ukraine, Saudi Arabia, Sweden and Thailand are also doing the same.

Do you think the Fed, the single most important central bank in the world, which controls the world’s reserve currency (the $USD) is going to sit back and let the world move into the digital currency space without moving itself?

No chance in hell.

Which means at some point in the not-so-distant future, the Fed will introduce “Fed Coin” or whatever its CBDC will be called

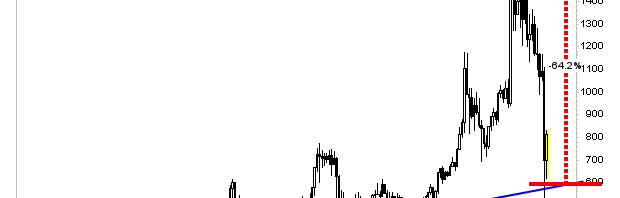

When that happens, 99.9% of crypto currencies will go to zero.

After all once the Fed introduces its own crypto currency, EVERY other crypto currency would then exist in direct competition to the Fed’s CBDC, which opens the door to charges of counterfeiting and other Federal felonies.

Currently crypto does NOT compete with the Fed because the Fed doesn’t have a CBDC yet. Once it does, everything changes.

Let me put it this way… what happened to Napster when iTunes showed up?

Bear in mind, Apple the company is nowhere near as powerful or formidable a competitor as the U.S. government. Someone might win a lawsuit against Apple. Very few people win lawsuits against the U.S. government.

Enjoy crypto in its current form, but know that it’s like Napster, and soon iTunes will come along.

Originally posted on www.gainspainscapital.com

Swing by to pick up three FREE investment reports valued at over $300 today.

Graham Summers

Chief Market Strategist

Phoenix Capital Research