Well, it’s confirmed, inflation is no longer just running hot… it is ROARING.

The Markit’s US Manufacturing PMI is a monthly survey that interviews managers in the private sector to see what they are experiencing in terms of business.

It’s widely considered to be one of the best gauges for the real state of the economy.

With that in mind the Markit’s US Manufacturing PMI for the month of May 2021 just revealed that the cost for input prices as well as new business at service providers have hit their highest levels since 2009.

As one well known economist put it, “average selling prices for goods and services are both rising at unprecedented rates, which will feed through to higher consumer inflation in coming months.”

Remember, inflation doesn’t just appear overnight. Instead, it slowly works its way into the financial system in phases.

1) Phase 1: Raw material price spikes

2) Phase 2: Factory gate prices spikes

3) Phase 3: Retail prices

The first stage occurs in the manufacturing/ production segment of the economy when you see producers suddenly paying more for the raw goods and commodities they use to manufacture/ produce finished goods.

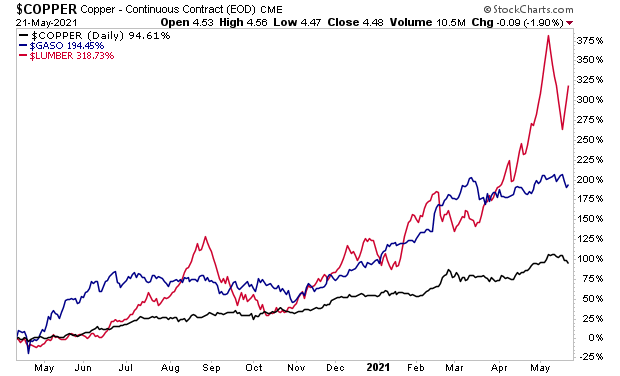

We first hit this stage several months ago as the below chart illustrates. The price of raw materials such as copper, lumber and even gasoline are all up triple digits in the last 12 months.

Now, one or two months of higher commodities or raw goods is no big deal, but once you’re talking 6-8 months of steadily rising prices it’s significant. At that point manufacturers/ producers are forced to start raising the prices of finished goods or face shrinking profit margins.

The Markit’s US Manufacturing PMI has confirmed that we are now officially at this point, revealing that the prices managers are paying for goods are rising at unprecedented rates.

Put another way, managers at real businesses in the U.S. are seeing the prices they must pay to obtain commodities/ raw goods and services, rise faster than ever before!

Again, NEVER before in the history of this data set have prices exploded this rapidly.

This means inflation is now ROARING.

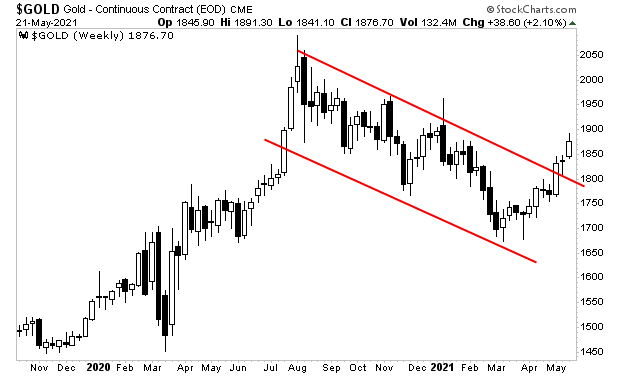

It also explains why gold has suddenly caught a bid, exploding out of a nine-month downtrend.

The above chart is telling us that gold was confused as to whether or not the Fed to stop inflation for most of the last year.

No longer.

Gold is now telling us that the Fed is not going to stop inflation. It is telling us that inflation is here and only going to get worse.

On that note, we just published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU.

We are making just 100 copies available to the public.

To pick up yours, swing by:

https://phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research