On Friday we outlined the strange price action in gold.

As a quick recap:

- Because we are in a fiat-based monetary regime, gold trades like any other asset.

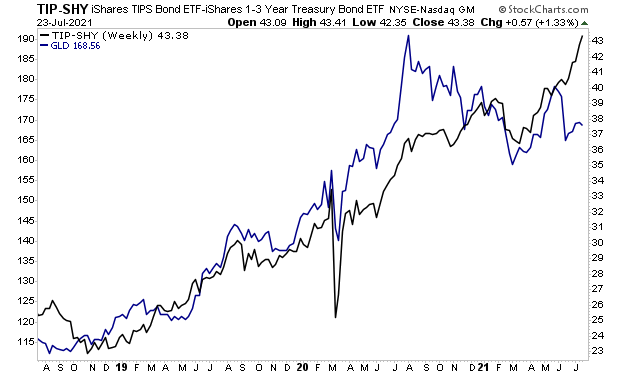

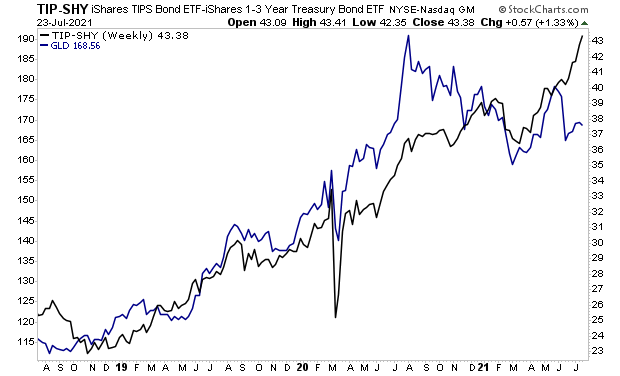

- Specifically, gold typically tracks “real rates” or the actual cost of money as illustrated by the difference between yields on Inflation Treasury Inflation-Protected Securities or TIPS and regular Treasuries).

- Recently a massive divergence has developed between real rates and gold.

Regarding #3 in the list above, the divergence between the two items is quite large, which means either real rates need to come down, or gold needs to catch up.

I believe we will see gold begin it next leg up relatively shortly.

Why?

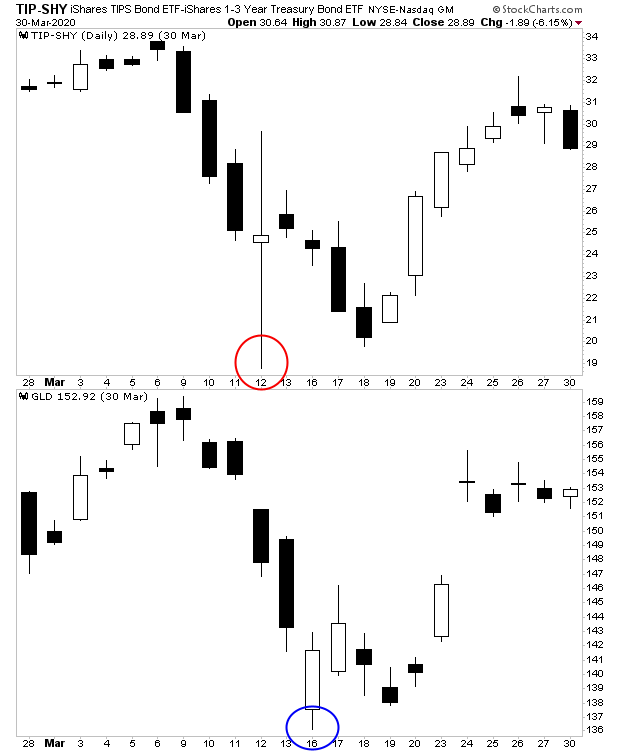

Because real rates usually lead gold on turns.

Let’s go back to the COVID-19 meltdown. Note that real rates (top box) bottomed a few days before gold did (bottom box). Real rates bottomed on March 12th, while gold bottomed on March 20th.

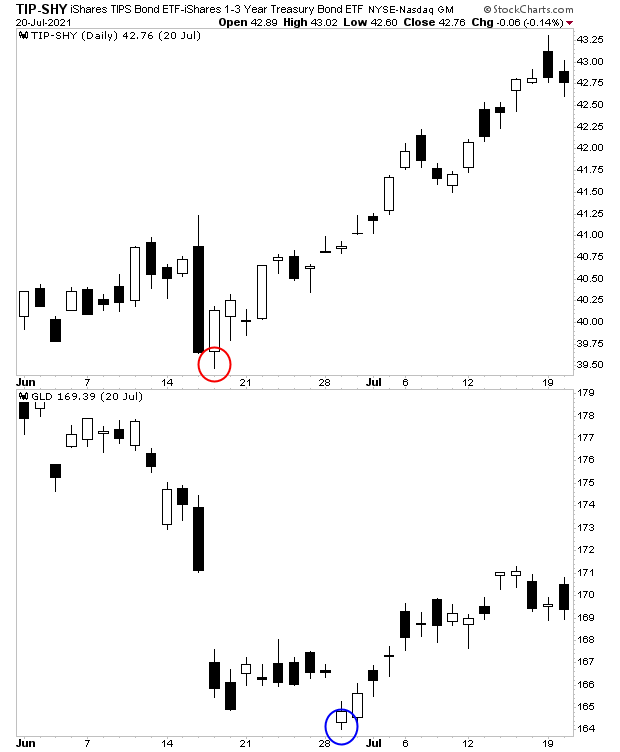

We saw this same dynamic play out again more recently in June of 2021 when real rates bottomed on the 17th of June (red circle) while gold didn’t bottom until the 29th (blue circle).

This would suggest that real rates will in fact lead gold higher going forward. Again, real rates have been soaring while gold is struggling to ignite higher. The below chart suggests gold will eventually be running to $2,000 per ounce in the coming months.

What would trigger a run like this?

Inflation.

I’ll outline how and why in tomorrow’s article until then.

In the meantime, if you’re concerned about inflation, we have published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU.

We are making just 100 copies available to the public.

To pick up yours, swing by:

https://phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research