Over the last two days, we’ve outlined how the bond market is predicting a surge in inflation.

By quick way of review:

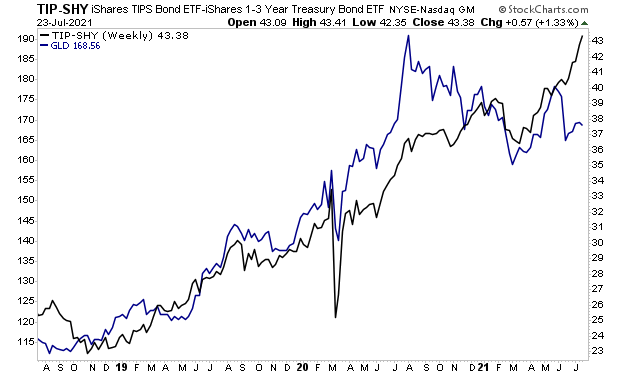

- Real rates, as measured by the difference between yields on Inflation Treasury Inflation-Protected Securities or TIPS and regular Treasuries have been surging higher (see the chart below).

- This means that TIPS are dramatically outperforming Treasuries right now. Since TIPs trade based on inflation expectations, this suggests that the bond market is predicting much higher inflation.

What would cause this?

Another round of massive money printing.

We’ve already noted that the Biden administration hopes to sign a $2-$4 trillion infrastructure program into law in the next few weeks. And after that there is talk of a $1.7 trillion climate change program.

Today, I’d like to tackle the Fed’s role in all of this.

The Fed is currently engaged in a $120 billion per month Quantitative Easing (QE) program. This comes to over $1.4 trillion in month printing per year.

Recently the Fed has been hinting that it intends to taper this program, and possibly start raising rates sometime in 2022/ early 2023. But by the look of things, that will no longer be the case.

Why?

Because the Biden administration recently leaked that it intends to give Jerome Powell as second term as Fed Chair starting in 2022.

The story was leaked via Bloomberg, which has a close relationship with the Biden administration. And it suggests that Jerome Powell has “cut a deal” with Joe Biden to stay on as Fed chair. After all, the only way that Joe Biden would give Jerome Powell a second term would be if the latter “got onboard” with Biden’s agenda.

That agenda?

Keep the economy as strong as possible going into the 2022 mid-terms.

This means NO tapering, NO rate hikes, and NO tightening of monetary conditions for the foreseeable future. Sure, the Fed might jawbone things or stage verbal interventions here and there to provide political cover, but there is no way on earth Jerome Powell can tighten monetary conditions in the near future if he wants to stay on as Fed Chair.

Which means…

Inflation is going to ROAR in the coming months.

On that note, if you’re concerned about inflation, we have published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU.

We are making just 100 copies available to the public.

To pick up yours, swing by:

https://phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research