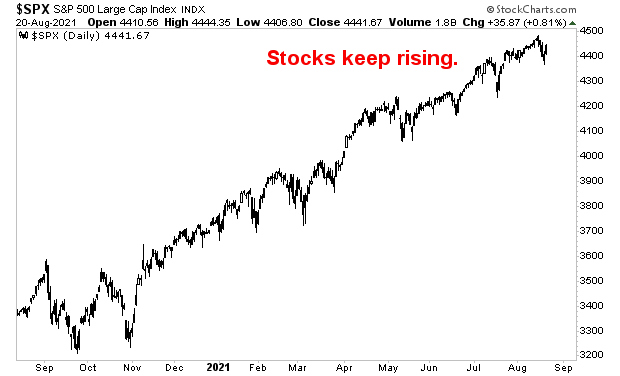

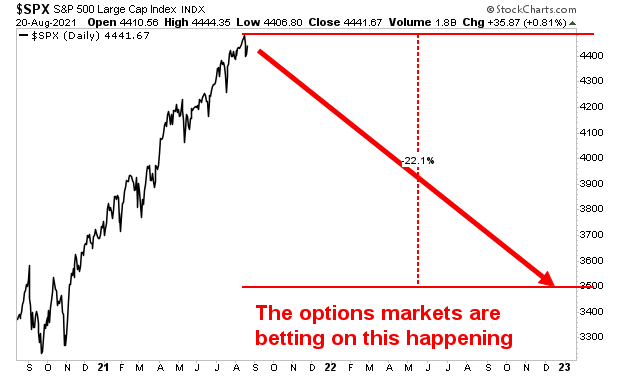

While the stock market continues to rise to new all-time highs, the options markets are betting on a massive crash.

If you’re unfamiliar with options, they are securities that give you the right, (but not the requirement) to buy shares in an underlying stock or ETF at some point in the future. The pricing and trading of options is a complicated thing, so for simplicity’s sake you can think of them as bets on where you think a given stock or ETF might trade at some point.

Goldman Sachs, noting that the options markets are pricing in a market crash similar to that of 1987 or 2008.

Goldman specifically notes that the options on the Volatility Index (VIX) that are due to expire 12 months from now are priced at 26.

Historically, the only time this contract has been priced at this kind of level has been around the 1987 Crash, the Great Financial Crisis of 2008 and the Coronavirus Crash of 2020.

Put another way, someone is betting and betting BIG that a crash is coming sometime in the next 12 months.

Obviously, this bubble, like all bubbles, will eventually burst. Smart investors are preparing for this in advance.

With that in mind, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

We are making just 100 copies available to the general public.

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist