OK, now things are getting really serious.

We all know the Fed is dead wrong about inflation. It is not transitory… and least not in the “it will go away by itself” kind of way the Fed claims.

Worse still, there is nothing the Fed can much of it.

As I’ve noted before, monetary policy cannot fix the supply chain/ labor problems in the economy. The Fed can’t print oil or coal. QE doesn’t make dock workers return to work and start unloading containers. Maintaining lower interest rates doesn’t resolve issues in shipping/ trucking/ manufacturing/ etc.

This situation was already a MAJOR problem when it pertained to microchips and other manufacturing goods. But now it’s spilling over into something more critical.

Food.

In case you missed it, yesterday Bloomberg reported that the current nitrogen shortage has become so problematic that farmers aren’t able to procure the necessary fertilizer to produce their usual crop yields.

So, are we going to have to add a FOOD crisis on top of the inflation that is headed our way?

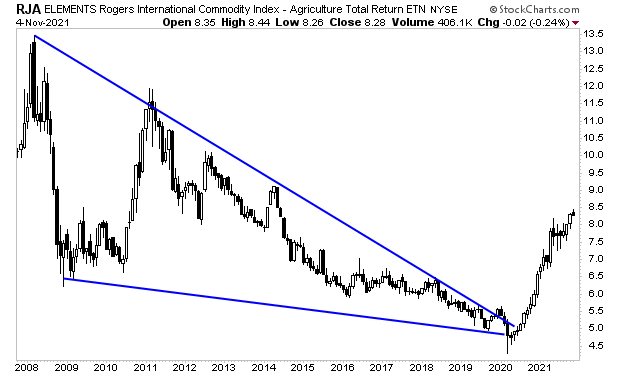

Take a look at the below chart of agricultural commodities and you tell me.

That’s a 12-year bear market ending in spectacular fashion. Food inflation was already here BEFORE this nitrogen shortage. So what happens when the next round of crops doesn’t get anywhere near what is expected?

A true inflationary storm.

It’s horrifying, but it has ALSO presented us with the opportunity to profit from once in a lifetime event: the arrival of an inflationary crisis that cannot be slowed or stopped by the Fed.

During the last major bout of inflation in the 1970s, smart investors locked in gains in the QUADRUPLE digits (1,000% or higher). And THAT version of inflation was the kind the Fed could stop!

I outline five investments that could explode higher as inflation rips through the financial system in a Special Investment Report titled Survive the Inflationary Storm.

To pick up a free copy, swing by

https://phoenixcapitalmarketing.com/inflationstorm.html

Best Regards