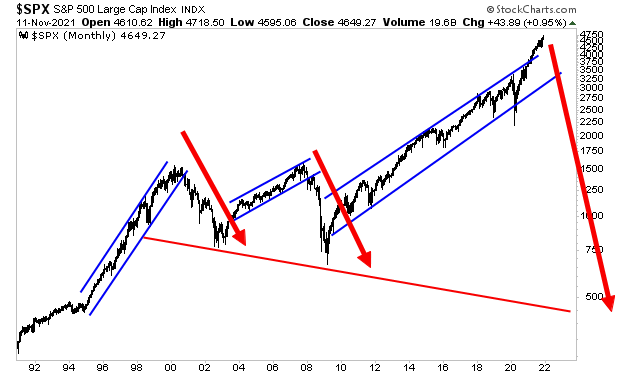

The great inflationary tidal wave continues to worsen. If anything, all signs indicate an absolute bloodbath is coming to the markets.

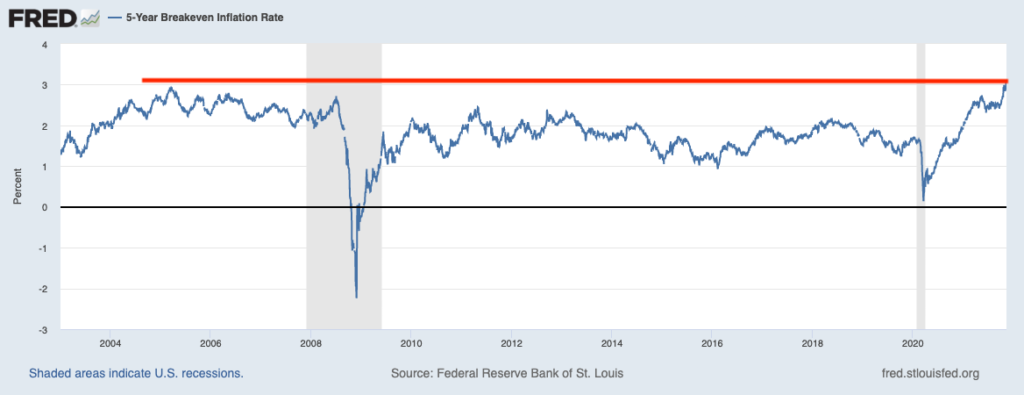

Five-year inflation breakeven’s just hit 3.11%. This is the highest reading running back to a least 2003. It’s higher than in 2011, when inflation triggered a food crisis around the globe. It’s also higher than in 2005-2006 when housing was in the largest bubble of all time and oil was about explode higher to $150 a barrel.

Put simply, the financial system is telling us that investors are terrified of inflation and that something truly horrific is coming our way. Worse still, by the look of things, the Fed will have a real problem on its hands trying to stop this.

Think of it this way… the last time five-year inflation break-evens were even close to this level was in 2005-2006 and the economy and financial system were about to begin the worst recession and financial crisis in 80+ years.

This time around, the situation is far worse. Back then, the economy was growing by 5%-6% and the Fed had interest rates at 5%+ so it had plenty of room to ease to cushion the collapse.

Today the economy is structurally crippled due to the after-effects of the 2020 lockdown while the Fed still has rates at ZERO. If you think the economy is strong, consider that the Fed has admitted it doesn’t believe it can raise rates until the second quarter of 2022 (at the earliest).

What kind of economy needs rates at zero to function?

Another key difference between the 2005-2006 period and today is that back then the Fed had yet to launch a single QE program. So, the impact of QE was still quite strong.

Today, the Fed is already engaged in a $120 billion QE program which it won’t fully end until mid 2022.

Put simply, in 2005/ 2006 the Fed was in a much better position to combat a collapsing economy/ financial crisis. This time around, the Fed has already used every tool at its disposal, including some tools (buying corporate debt, municipal debt, etc.) that it technically shouldn’t be allowed to buy at all!

What will the Fed be forced to do when this happens? Cut rates into negative territory? Monthly QE of $250 billion? $500 billion? And what’s going to happen to the markets when this insane bubble bursts and this happens?

Even more importantly for investors…HOW DO WE AVOID THIS?

To figure this out, I rely on certain key signals that flash before every market crash.

I detail them, along with what they’re currently saying about the market today in a Special Investment Report How to Predict a Crash.

To pick up a free copy, swing by

https://phoenixcapitalmarketing.com/predictcrash.html

Best Regards